Clearwire 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.even if that attribution results in a deficit non-controlling interest balance. See Note 14, Stockholders’ Equity, for

further information.

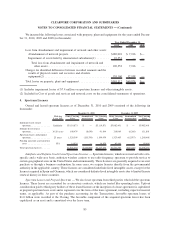

Reclassifications — During 2010 we reclassified losses from abandonment and impairment of network and

other assets from Cost of goods and services and network costs to a separate line item in the consolidated statements

of operations. We also reclassified costs associated with ongoing maintenance of network assets that have been

deployed from Selling, general and administrative expense to Cost of goods and services and network costs.

Additionally, we reclassified certain amounts from Accounts payable and accrued expenses to Other current

liabilities. To conform with the 2010 presentation, certain reclassifications have been made to the prior period

amounts.

Use of Estimates — Our accounting policies require management to make complex and subjective judgments.

By their nature, these judgments are subject to an inherent degree of uncertainty. These judgments are based on our

historical experience, terms of existing contracts, observance of trends in the industry, information provided by our

subscribers and information available from other outside sources, as appropriate. Additionally, changes in

accounting estimates are reasonably likely to occur from period to period. These factors could have a material

impact on our financial statements, the presentation of our financial condition, changes in financial condition or

results of operations.

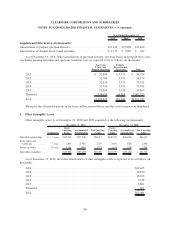

Significant estimates inherent in the preparation of the accompanying financial statements include: impair-

ment analysis of spectrum licenses with indefinite lives, the recoverability and determination of useful lives for

long-lived assets, which include property, plant and equipment and other intangible assets, tax valuation allow-

ances, and valuation of derivatives.

Subsequent Events — We evaluated subsequent events occurring through the date the financial statements

were issued.

Cash and Cash Equivalents — Cash equivalents consist of money market mutual funds and highly liquid

short-term investments with original maturities of three months or less. Cash equivalents are stated at cost, which

approximates market value. Cash and cash equivalents exclude cash that is contractually restricted for operational

purposes. We maintain cash and cash equivalent balances with financial institutions that exceed federally insured

limits. We have not experienced any losses related to these balances, and management believes the credit risk

related to these balances to be minimal.

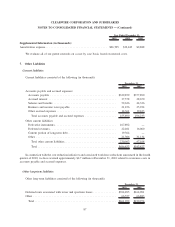

Restricted Cash — Restricted cash consists primarily of amounts we have set aside to satisfy certain

contractual obligations and is classified as a current or noncurrent asset based on its designated purpose. The

majority of this restricted cash has been designated to satisfy certain vendor contractual obligations.

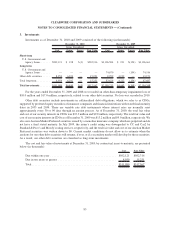

Investments — We have an investment portfolio comprised of U.S. Government and Agency Issues and other

debt securities. The value of these securities is subject to market and credit volatility during the period the

investments are held and until their sale or maturity. We classify marketable debt securities as available-for-sale

investments and these securities are stated at their estimated fair value. Our investments that are available for current

operations are recorded as short-term investments when the original maturities are greater than three months but

remaining maturities are less than one year. Our investments with maturities of more than one year are recorded as

long-term investments. Unrealized gains and losses are recorded within accumulated other comprehensive income

(loss). Realized gains and losses are measured and reclassified from accumulated other comprehensive income

(loss) on the basis of the specific identification method.

We recognize realized losses when declines in the fair value of our investments below their cost basis are

judged to be other-than-temporary. In determining whether a decline in fair value is other-than-temporary, we

consider various factors including market price (when available), investment ratings, the financial condition and

near-term prospects of the issuer, the length of time and the extent to which the fair value has been less than the cost

basis, and our intent and ability to hold the investment until maturity or for a period of time sufficient to allow for

77

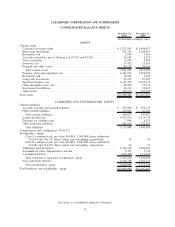

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)