Clearwire 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

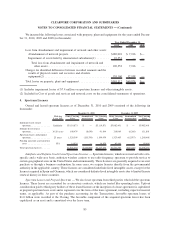

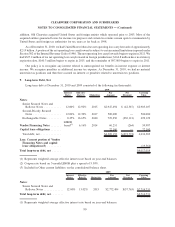

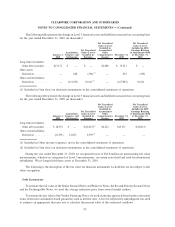

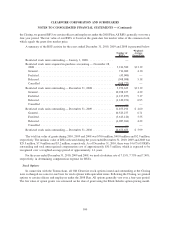

The following table presents the change in Level 3 financial assets and liabilities measured on a recurring basis

for the year ended December 31, 2010 (in thousands):

January 1,

2010

Acquisitions,

Issuances and

Settlements

Net Unrealized

Gains (Losses)

Included in

Earnings

Net Unrealized

Gains (Losses)

Included in

Accumulated

Other

Comprehensive

Income

December 31,

2010

Net Unrealized

Gains (Losses)

Included in 2010

Earnings Relating

to Instruments Held

at December 31,

2010

Long-term investments:

Other debt securities . . . . $13,171 $ — $ — $2,080 $ 15,251 $ —

Other assets:

Derivatives . . . . . . . . . . . — 648 (356)

(1)

— 292 (356)

Other current liabilities:

Derivatives . . . . . . . . . . . — (231,503) 63,611

(1)

— (167,892) 63,611

(1) Included in Gain (loss) on derivative instruments in the consolidated statements of operations.

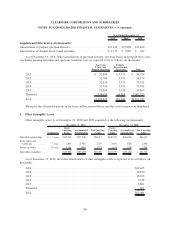

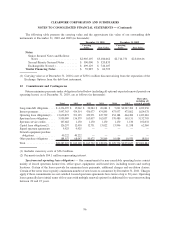

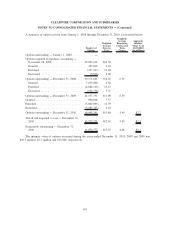

The following table presents the change in Level 3 financial assets and liabilities measured on a recurring basis

for the year ended December 31, 2009 (in thousands):

January 1,

2009

Acquisitions,

Issuances and

Settlements

Net Unrealized

Gains (Losses)

Included in

Earnings

Net Unrealized

Gains (Losses)

Included in

Accumulated

Other

Comprehensive

Income

December 31,

2009

Net Unrealized

Gains (Losses)

Included in 2009

Earnings Relating

to Instruments Held

at December 31,

2009

Long-term investments:

Other debt securities . . . . $ 18,974 $ — $(10,015)

(1)

$4,212 $13,171 $(10,015)

Other current liabilities:

Derivatives . . . . . . . . . . . (21,591) 14,652 6,939

(2)

—— —

(1) Included in Other income (expense), net in the consolidated statements of operations.

(2) Included in Gain (loss) on derivative instruments in the consolidated statements of operations.

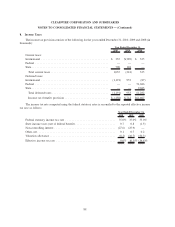

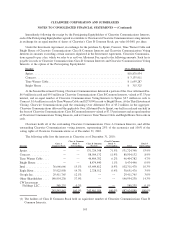

During the year ended December 31, 2010, we recognized losses of $10.8 million on nonrecurring fair value

measurements, which were categorized as Level 3 measurements, on certain assets held and used by international

subsidiaries. We no longer hold these assets at December 31, 2010.

The following is the description of the fair value for financial instruments we hold that are not subject to fair

value recognition.

Debt Instruments

To estimate the fair value of the Senior Secured Notes and Rollover Notes, the Second-Priority Secured Notes

and the Exchangeable Notes, we used the average indicative price from several market makers.

To estimate the fair value of the Vendor Financing Notes, we used an income approach based on the contractual

terms of the notes and market-based parameters such as interest rates. A level of subjectivity and judgment was used

to estimate an appropriate discount rate to calculate the present value of the estimated cashflows.

95

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)