Clearwire 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

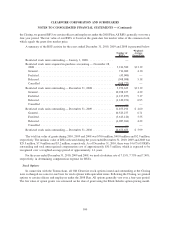

the Closing, we granted RSUs to certain officers and employees under the 2008 Plan. All RSUs generally vest over a

four-year period. The fair value of our RSUs is based on the grant-date fair market value of the common stock,

which equals the grant date market price.

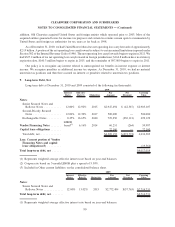

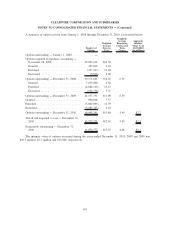

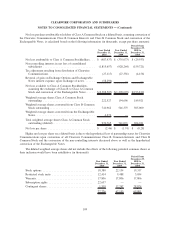

A summary of the RSU activity for the years ended December 31, 2010, 2009 and 2008 is presented below:

Number of

RSU’s

Weighted-

Average

Grant Price

Restricted stock units outstanding — January 1, 2008 ................ —

Restricted stock units acquired in purchase accounting — November 28,

2008 .................................................. 3,216,500 $13.19

Granted ................................................ 716,000 4.10

Forfeited ............................................... (43,000) —

Released ............................................... (508,098) 5.18

Cancelled .............................................. (108,777) —

Restricted stock units outstanding — December 31, 2008 ............. 3,272,625 $13.19

Granted ................................................ 10,938,677 4.39

Forfeited ............................................... (1,217,857) 5.17

Released ............................................... (1,140,251) 6.95

Cancelled .............................................. — —

Restricted stock units outstanding — December 31, 2009 ............. 11,853,194 $ 4.60

Granted ................................................ 10,523,277 6.71

Forfeited ............................................... (3,613,124) 5.55

Released ............................................... (4,087,694) 4.22

Cancelled .............................................. — —

Restricted stock units outstanding — December 31, 2010 ............. 14,675,653 $ 5.99

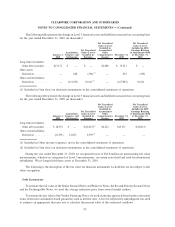

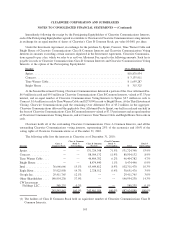

The total fair value of grants during 2010, 2009 and 2008 was $70.6 million, $48.0 million and $2.9 million,

respectively. The intrinsic value of RSUs released during the years ended December 31, 2010, 2009 and 2008 was

$29.5 million, $7.9 million and $3.2 million, respectively. As of December 31, 2010, there were 14,675,653 RSUs

outstanding and total unrecognized compensation cost of approximately $50.3 million, which is expected to be

recognized over a weighted-average period of approximately 1.6 years.

For the years ended December 31, 2010, 2009 and 2008, we used a forfeiture rate of 7.15%, 7.75% and 7.50%,

respectively, in determining compensation expense for RSUs.

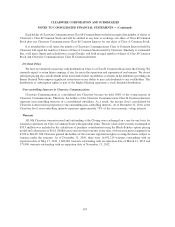

Stock Options

In connection with the Transactions, all Old Clearwire stock options issued and outstanding at the Closing

were exchanged on a one-for-one basis for stock options with equivalent terms. Following the Closing, we granted

options to certain officers and employees under the 2008 Plan. All options generally vest over a four-year period.

The fair value of option grants was estimated on the date of grant using the Black-Scholes option pricing model.

100

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)