Clearwire 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

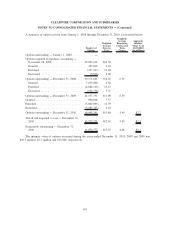

Class B Common Stock

The Class B Common Stock represents non-economic voting interests in Clearwire, and holders of this stock

are considered the non-controlling interests for the purposes of financial reporting. Identical to the Class A Common

Stock, the holders of Class B Common Stock are entitled to one vote per share. However, they do not have any rights

to receive distributions other than stock dividends paid proportionally to each outstanding Class A and Class B

Common Stockholder or upon liquidation of Clearwire, an amount equal to the par value per share, which is

$0.0001 per share.

Each holder of Class B Common Stock holds an equivalent number of Clearwire Communications Class B

Common Interests, which, in substance, reflects their economic stake in Clearwire. This is accomplished through an

exchange feature that provides the holder the right, at any time, to exchange one share of Class B Common Stock

plus one Clearwire Communications Class B Common Interest for one share of Class A Common Stock.

Private Placement

On November 9, 2009, we entered into an investment agreement, which we refer to as the Investment

Agreement, with each of Sprint, Comcast Corporation, which we refer to as Comcast, Intel Corporation, which we

refer to as Intel, Time Warner Cable Inc., which we refer to as Time Warner Cable, Bright House Networks, LLC,

which we refer to as Bright House, and Eagle River Holdings LLC, which we refer to as Eagle River, who we

collectively refer to as the Participating Equityholders, providing for additional equity investments by the

Participating Equityholders and new debt investments by certain of these investors. The Investment Agreement

sets forth the terms of the transactions pursuant to which the Participating Equityholders invested in Clearwire

Communications an aggregate of approximately $1.564 billion in exchange for 213,369,711 shares of Clearwire

Communications non-voting Class B Common Interest and Clearwire Communications voting interests, which we

refer to as the Private Placement, and the investment by certain of the Participating Equityholders in Rollover Notes.

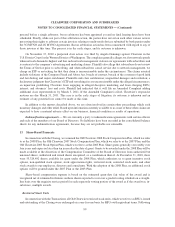

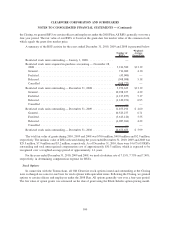

The Private Placement was consummated in three closings. On November 9, 2009, the Participating

Equityholders contributed in aggregate approximately $1.057 billion in cash in exchange for 144,231,268

Clearwire Communications Class B Common Interests, and Clearwire Communications voting interests, which

we collectively refer to as Clearwire Communications Interests, pro rata based on their respective investment

amounts. We refer to this closing as the First Investment Closing. On December 21, 2009, the Participating

Equityholders contributed in aggregate approximately $440.3 million in cash in exchange for 60,066,822 Clearwire

Communications Interests. We refer to this closing as the Second Investment Closing. On March 2, 2010, the

Participating Equityholders contributed in aggregate approximately $66.5 million in cash in exchange for 9,071,621

Clearwire Communications Interests. We refer to the consummation of this purchase as the Third Investment

Closing.

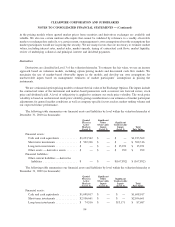

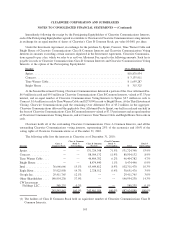

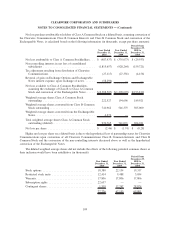

In the Private Placement, the Participating Equityholders agreed to invest in Clearwire Communications a total

of $1.564 billion in exchange for Clearwire Communications Interests in the following amounts (in millions, except

for Interests):

Investor Investment Interests

Sprint................................................... $1,176.0 160,436,562

Comcast ................................................. 196.0 26,739,427

Time Warner Cable ........................................ 103.0 14,051,841

Bright House ............................................. 19.0 2,592,087

Intel .................................................... 50.0 6,821,282

Eagle River .............................................. 20.0 2,728,512

$1,564.0 213,369,711

104

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)