Clearwire 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

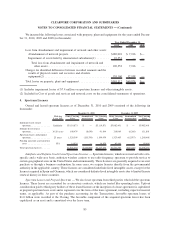

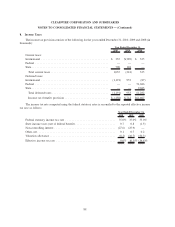

addition, Old Clearwire acquired United States and foreign entities which operated prior to 2003. Most of the

acquired entities generated losses for income tax purposes and certain tax returns remain open to examination by

United States and foreign tax authorities for tax years as far back as 1998.

As of December 31, 2010, we had United States federal tax net operating loss carryforwards of approximately

$2.19 billion. A portion of the net operating loss carryforward is subject to certain annual limitations imposed under

Section 382 of the Internal Revenue Code of 1986. The net operating loss carryforwards begin to expire in 2021. We

had $327.2 million of tax net operating loss carryforwards in foreign jurisdictions; $166.8 million have no statutory

expiration date, $160.3 million begins to expire in 2015, and the remainder of $97,000 begins to expire in 2011.

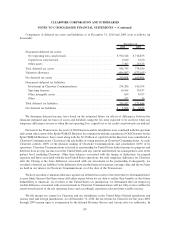

Our policy is to recognize any interest related to unrecognized tax benefits in interest expense or interest

income. We recognize penalties as additional income tax expense. As December 31, 2010, we had no material

uncertain tax positions and therefore accrued no interest or penalties related to uncertain tax positions.

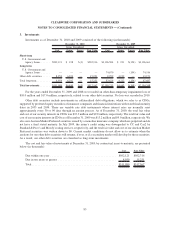

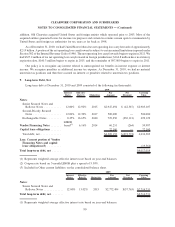

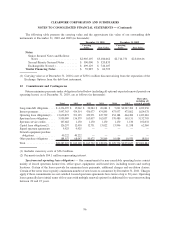

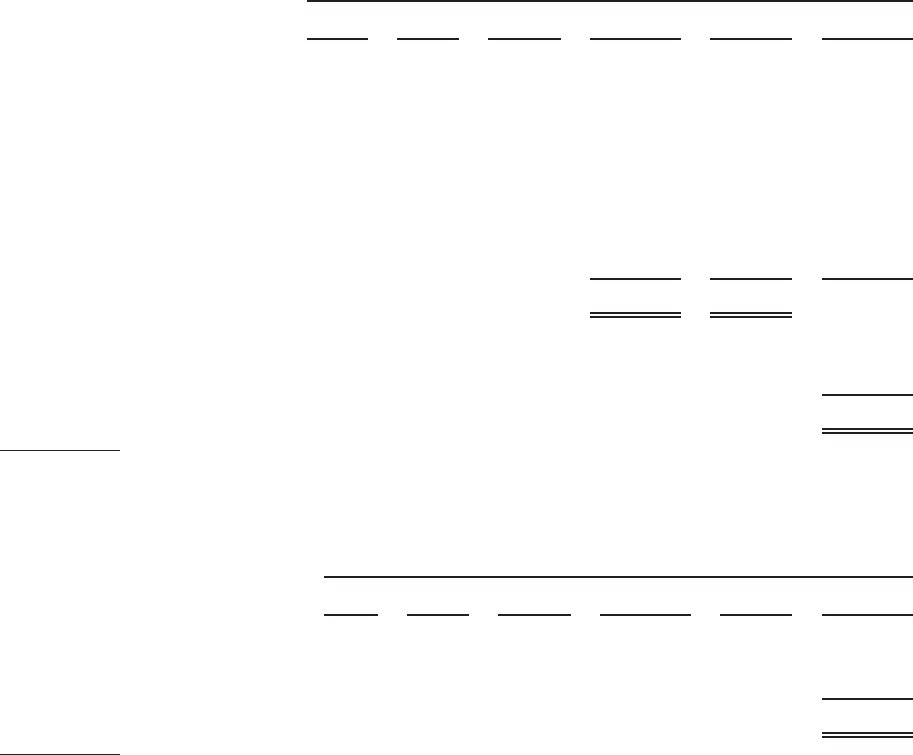

9. Long-term Debt, Net

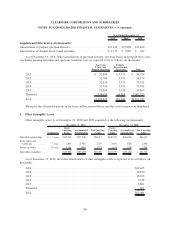

Long-term debt at December 31, 2010 and 2009 consisted of the following (in thousands):

Interest

Rates

Effective

Rate(1) Maturities

Par

Amount

Net

Discount

Carrying

Value

2010

Notes:

Senior Secured Notes and

Rollover Notes ........... 12.00% 12.92% 2015 $2,947,494 $ (42,387) $2,905,107

Second-Priority Secured

Notes .................. 12.00% 12.39% 2017 500,000 — 500,000

Exchangeable Notes ......... 8.25% 16.65% 2040 729,250 (230,121) 499,129

Vendor Financing Notes .......

LIBOR

based

(2)

6.16% 2014 60,251 (264) 59,987

Capital lease obligations ....... 72,160 — 72,160

Total debt, net.............. $4,309,155 $(272,772) 4,036,383

Less: Current portion of Vendor

Financing Notes and capital

lease obligations(3) ......... (19,364)

Total long-term debt, net ...... $4,017,019

(1) Represents weighted average effective interest rate based on year-end balances.

(2) Coupon rate based on 3-month LIBOR plus a spread of 5.50%.

(3) Included in Other current liabilities on the consolidated balance sheet.

Interest

Rates

Effective

Rate(1) Maturities

Par

Amount

Net

Discount

Carrying

Value

2009

Notes:

Senior Secured Notes and

Rollover Notes ............. 12.00% 13.02% 2015 $2,772,494 $(57,763) $2,714,731

Total long-term debt, net ........ $2,714,731

(1) Represents weighted average effective interest rate based on year-end balances.

90

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)