Clearwire 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

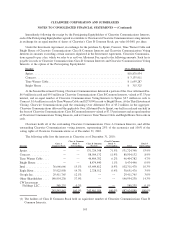

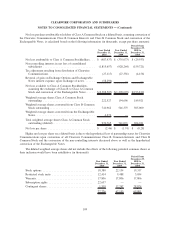

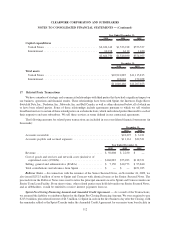

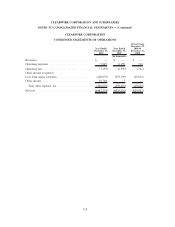

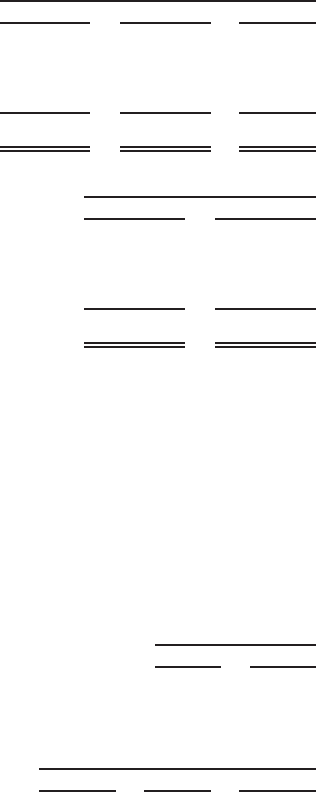

2010 2009 2008

Year Ended December 31,

Capital expenditures

United States ................................. $2,654,612 $1,533,918 $573,537

International .................................. 10,138 6,112 1,420

$2,664,750 $1,540,030 $574,957

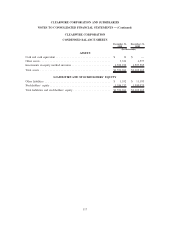

2010 2009

December 31,

Total assets

United States ......................................... $10,921,885 $11,115,815

International .......................................... 118,601 152,038

$11,040,486 $11,267,853

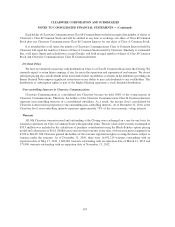

17. Related Party Transactions

We have a number of strategic and commercial relationships with third parties that have had a significant impact on

our business, operations and financial results. These relationships have been with Sprint, the Investors, Eagle River,

Switch & Data, Inc., Dashwire, Inc., Motorola, Inc. and Bell Canada, as well as others discussed below, all of which are

or have been related parties. Some of these relationships include agreements pursuant to which we sell wireless

broadband services to certain of these related parties on a wholesale basis, which such related parties then resell to each of

their respective end user subscribers. We sell these services at terms defined in our contractual agreements.

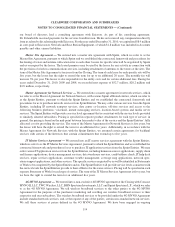

The following amounts for related party transactions are included in our consolidated financial statements (in

thousands):

2010 2009

December 31,

Accounts receivable ............................................ $22,297 $ 3,221

Accounts payable and accrued expenses ............................. $11,161 $22,521

2010 2009 2008

Year Ended December 31,

Revenue .......................................... $ 50,808 $ 2,230 $ —

Cost of goods and services and network costs (inclusive of

capitalized costs) (COGS)............................ $104,883 $75,283 $118,331

Selling, general and administrative (SG&A) ................ $ 7,150 $10,773 $ 95,840

Total contributions and advances from Sprint ............... $ — $ — $451,925

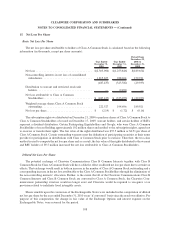

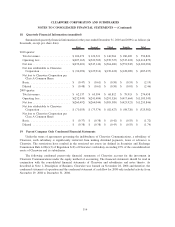

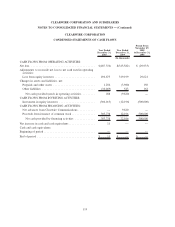

Rollover Notes — In connection with the issuance of the Senior Secured Notes, on November 24, 2009, we

also issued $252.5 million of notes to Sprint and Comcast with identical terms as the Senior Secured Notes. The

proceeds from the Rollover Notes were used to retire the principal amounts owed to Sprint and Comcast under our

Senior Term Loan Facility. From time to time, other related parties may hold debt under our Senior Secured Notes,

and as debtholders, would be entitled to receive interest payments from us.

Sprint Pre-Closing Financing Amount and Amended Credit Agreement — As a result of the Transactions,

we assumed the liability to reimburse Sprint for the Sprint Pre-Closing Financing Amount. We were required to pay

$213.0 million, plus related interest of $4.5 million, to Sprint in cash on the first business day after the Closing, with

the remainder added as the Sprint Tranche under the Amended Credit Agreement for our senior term loan facility in

112

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)