Clearwire 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

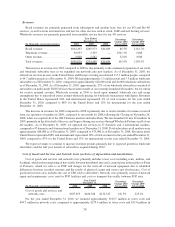

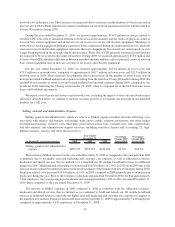

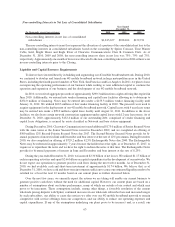

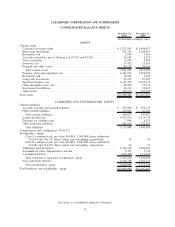

Non-controlling Interests in Net Loss of Consolidated Subsidiaries

(In thousands, except percentages) 2010 2009 2008

Year Ended

December 31,

Non-controlling interests in net loss of consolidated

subsidiaries .................................... $1,815,657 $928,264 $159,721

The non-controlling interests in net loss represent the allocation of a portion of the consolidated net loss to the

non-controlling interests in consolidated subsidiaries based on the ownership by Sprint, Comcast, Time Warner

Cable, Intel, Bright House and Eagle River of Clearwire Communications Class B Common Units. As of

December 31, 2010, 2009 and 2008, the non-controlling interests share in net loss was 75%, 79% and 73%,

respectively. Approximately one month of losses was allocated to the non-controlling interests in 2008 as there were

no non-controlling interests prior to the Closing.

Liquidity and Capital Resource Requirements

To date we have invested heavily in building and augmenting our 4G mobile broadband network. During 2010,

we continued to develop and launch our 4G mobile broadband network in large metropolitan areas in the United

States, including the fourth quarter launches of New York, San Francisco and Los Angeles. In 2011, we plan to focus

on improving the operating performance of our business while seeking to raise additional capital to continue the

operation and expansion of our business and the development of our 4G mobile broadband network.

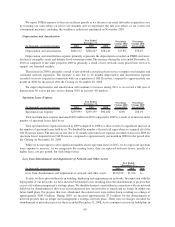

In 2010, we received aggregate proceeds of approximately $290.3 million from a rights offering that expired in

June 2010. Additionally, we entered into vendor financing and capital lease facilities allowing us to obtain up to

$254.0 million of financing. Notes may be entered into under a $155.3 million vendor financing facility until

January 31, 2012. We utilized $60.3 million of this vendor financing facility in 2010. The proceeds were used to

acquire equipment for the deployment of our 4G mobile broadband network. Capital leases with 4 year lease terms

may be entered into under a $99.0 million capital lease facility until August 16, 2011. In addition to the above

facilities, we also lease certain network construction equipment under capital leases with 12 year lease terms. As of

December 31, 2010, approximately $132.4 million of our outstanding debt, comprised of vendor financing and

capital lease obligations, is secured by assets classified as Network and base station equipment.

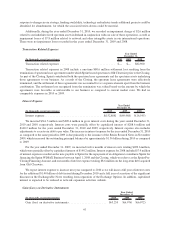

During December 2010, Clearwire Communications issued additional $175.0 million of Senior Secured Notes

with the same terms as the Senior Secured Notes issued in December 2009, and we completed an offering of

$500 million 12% Second-Priority Secured Notes due 2017. The Second-Priority Secured Notes provide for bi-

annual payments of interest in June and December and bear interest at the rate of 12% per annum. During December

2010, we also completed an offering of $729.2 million 8.25% Exchangeable Notes due 2040. The Exchangeable

Notes may be redeemed in approximately 7 years because the holders have the right, as of December 17, 2017, to

require us to repurchase the notes and we have the right to redeem the notes at that time. The Exchangeable Notes

provide for bi-annual payments of interest in June and December and bear interest at the rate of 8.25%.

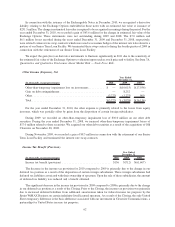

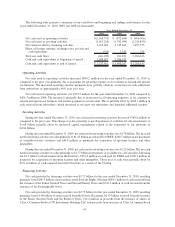

During the year ended December 31, 2010, we incurred $2.30 billion of net losses. We utilized $1.17 billion of

cash in operating activities and spent $2.66 billion on capital expenditures in the development of our networks. We

do not expect our operations to generate positive cash flows during the next twelve months. As of December 31,

2010, we had available cash and short-term investment of approximately $1.74 billion. We believe that, as of

December 31, 2010, we have cash and short-term investments sufficient to cause our estimated liquidity needs to be

satisfied for at least the next 12 months based on our current plans as further discussed below.

Over the next few years, we currently expect the actions we are taking will enable our current business to

generate positive cash flows without the need for additional capital. However, our current plans are based on a

number of assumptions about our future performance, many of which are outside of our control and which may

prove to be inaccurate. These assumptions include, among other things, a favorable resolution of the current

wholesale pricing disputes with Sprint, continued increases in our wholesale subscriber base and increased usages

by such subscribers, our ability to cause the services we offer over our 4G mobile broadband network to remain

competitive with service offerings from our competitors, and our ability to reduce our operating expenses and

capital expenditures. If any of the assumptions underlying our plans prove to be incorrect and, as a result, our

63