Clearwire 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

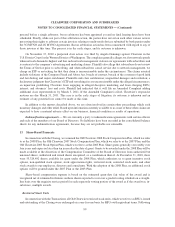

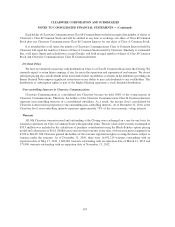

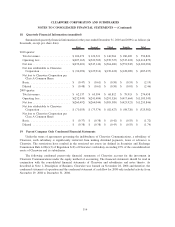

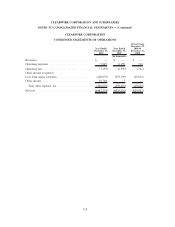

Net loss per share attributable to holders of Class A Common Stock on a diluted basis, assuming conversion of

the Clearwire Communications Class B Common Interests and Class B Common Stock and conversion of the

Exchangeable Notes, is calculated based on the following information (in thousands, except per share amounts):

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Period From

November 29,

2008 to

December 31,

2008

Net loss attributable to Class A Common Stockholders . . . $ (487,437) $ (335,073) $ (29,933)

Non-controlling interests in net loss of consolidated

subsidiaries . ................................ (1,815,657) (928,264) (159,721)

Tax adjustment resulting from dissolution of Clearwire

Communications.............................. (27,117) (27,356) (4,158)

Reversal of gain on Exchange Options and Exchangeable

Notes interest expense, upon exchange of notes ....... (58,296) — —

Net loss available to Class A Common Stockholders,

assuming the exchange of Class B to Class A Common

Stock and conversion of the Exchangeable Notes...... $(2,388,507) $(1,290,693) $(193,812)

Weighted average shares Class A Common Stock

outstanding . ................................ 222,527 194,696 189,921

Weighted average shares converted from Class B Common

Stock outstanding ............................. 741,962 546,375 505,000

Weighted average shares converted from the Exchangeable

Notes ...................................... 6,276 — —

Total weighted average shares Class A Common Stock

outstanding (diluted) ........................... 970,765 741,071 694,921

Net loss per share .............................. $ (2.46) $ (1.74) $ (0.28)

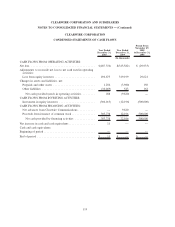

Higher net loss per share on a diluted basis is due to the hypothetical loss of partnership status for Clearwire

Communications upon conversion of all Clearwire Communications Class B Common Interests and Class B

Common Stock and the conversion of the non-controlling interests discussed above as well as the hypothetical

conversion of the Exchangeable Notes.

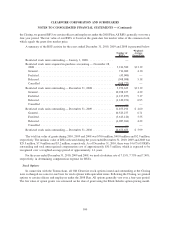

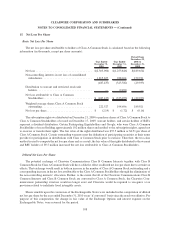

The diluted weighted average shares did not include the effects of the following potential common shares as

their inclusion would have been antidilutive (in thousands):

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Period From

November 29,

2008 to

December 31,

2008

Stock options ................................ 18,380 22,154 19,317

Restricted stock units .......................... 12,414 9,488 3,054

Warrants .................................... 17,806 17,806 17,806

Subscription rights ............................ 22,657 — —

Contingent shares ............................. 1,519 12,747 28,824

72,776 62,195 69,001

109

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)