Clearwire 2010 Annual Report Download - page 84

Download and view the complete annual report

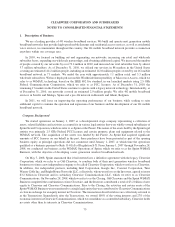

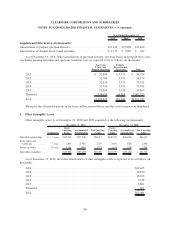

Please find page 84 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the assets once the assets are placed in service. Our network construction expenditures are recorded as construction

in progress until the network or other asset is placed in service, at which time the asset is transferred to the

appropriate PP&E category. We capitalize costs of additions and improvements, including salaries, benefits and

related overhead costs associated with constructing PP&E and interest costs related to construction. The estimated

useful life of equipment is determined based on historical usage of identical or similar equipment, with consid-

eration given to technological changes and industry trends that could impact the network architecture and asset

utilization. Leasehold improvements are recorded at cost and amortized over the lesser of their estimated useful

lives or the related lease term, including renewals that are reasonably assured. Maintenance and repairs are

expensed as incurred.

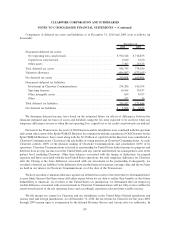

PP&E is assessed for impairment whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable. When such events or circumstances exist, we determine the

recoverability of the asset’s carrying value by estimating the expected undiscounted future cash flows that are

directly associated with and that are expected to arise as a direct result of the use of the asset. If the expected

undiscounted future cash flows are less than the carrying amount of the asset, a loss is recognized for the difference

between the fair value of the asset and its carrying value. For purposes of testing impairment, our long-lived assets,

including PP&E and intangible assets with definite useful lives, and our spectrum license assets in the United States

are combined into a single asset group. This represents the lowest level for which there are identifiable cash flows

which are largely independent of other assets and liabilities, and management believes that utilizing these assets as a

group represents the highest and best use of the assets and is consistent with management’s strategy of utilizing our

spectrum licenses on an integrated basis as part of our nationwide networks. Internationally, for purposes of testing

impairment, our long-lived assets, consisting of PP&E, definite-lived intangible assets and our spectrum assets are

primarily combined into a single asset group for each country in which we operate. In the third quarter of 2010, due

to our continued losses and significant uncertainties surrounding our ability to obtain required liquidity to fund our

operating and capital needs, management concluded that an adverse change in circumstances existed requiring us to

assess the recoverability of the carrying value of our long-lived assets. Based on this assessment, we determined that

the carrying value of our long-lived assets in the United States was recoverable, primarily supported by the fair

value of our spectrum licenses. Management has determined that a similar assessment was not necessary in the

fourth quarter. For the year ended December 31, 2010, we recorded impairment losses of $6.6 million relating to

PP&E and other long-lived assets in our international operations. There were no PP&E impairment losses recorded

in the years ended December 31, 2009 and 2008.

In addition to the analyses described above, we periodically assess certain assets that have not yet been

deployed in our networks, including equipment and cell site development costs. This assessment includes the

provision for identified differences between recorded amounts and the results of physical counts and the write-off of

network equipment and cell site development costs whenever events or changes in circumstances cause us to

conclude that such assets are no longer needed to meet management’s strategic network plans and will not be

deployed. With the substantial completion of our prior build plans and due to the uncertainty of the extent and

timing of future expansion of our networks, we reviewed all network projects in process. Any projects that no longer

fit within management’s strategic network plans were abandoned and the related costs written down, resulting in a

charge of approximately $180.0 million. See Note 4, Property, Plant and Equipment, for further information.

Internally Developed Software — We capitalize costs related to computer software developed or obtained for

internal use, and interest costs incurred during the period of development. Software obtained for internal use has

generally been enterprise-level business and finance software customized to meet specific operational needs. Costs

incurred in the application development phase are capitalized and amortized over the useful life of the software,

which is generally three years. Costs recognized in the preliminary project phase and the post-implementation

phase, as well as maintenance and training costs, are expensed as incurred.

79

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)