Clearwire 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

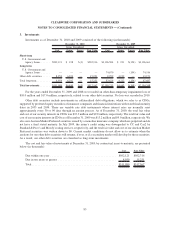

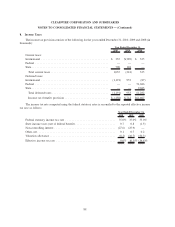

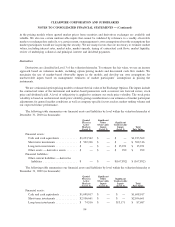

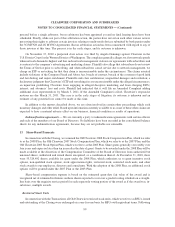

Interest Expense — Interest expense included in our consolidated statements of operations for the years ended

December 31, 2010, 2009 and 2008, consisted of the following (in thousands):

2010 2009 2008

Year Ended December 31,

Interest coupon ........................................... $346,984 $ 145,453 $19,347

Accretion of debt discount and amortization of debt premium, net ...... 14,479 64,183 1,667

Capitalized interest......................................... (208,595) (140,168) (4,469)

$ 152,868 $ 69,468 $16,545

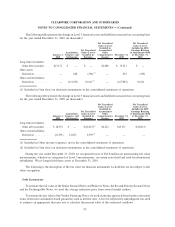

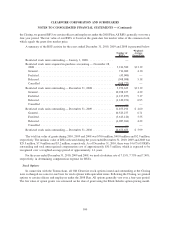

10. Derivative Instruments

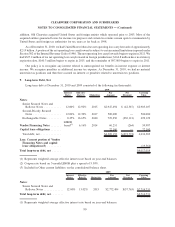

The holders’ exchange rights contained in the Exchangeable Notes issued in December 2010 constitute

embedded derivative instruments that are required to be accounted for separately from the debt host instrument at

fair value. As a result, upon the issuance of the Exchangeable Notes, we recognized exchange options, which we

refer to as Exchange Options, with an estimated fair value of $231.5 million as a derivative liability. The Exchange

Options are indexed to Class A Common Stock, have a notional amount of 103.0 million shares and mature in 2040.

We do not apply hedge accounting to the Exchange Options. Therefore, gains and losses due to changes in fair value

are reported in our consolidated statements of operations. At December 31, 2010, the Exchange Options’ estimated

fair value of $167.9 million was reported in other current liabilities on our consolidated balance sheet. For the year

ended December 31, 2010, we recognized a gain of $63.6 million from the changes in the estimated fair value since

inception in gain (loss) on derivative instruments in our consolidated statements of operations. See Note 11, Fair

Value, for information regarding valuation of the Exchange Options.

During 2009, we had two interest rate swap contracts which were based on 3-month LIBOR with a combined

notional of $600.0 million. We used these swaps as economic hedges of the interest rate risk related to a portion of

our long-term debt. The interest rate swaps were used to reduce the variability of future interest payments on our

LIBOR based debt. We were not holding these interest rate swap contracts for trading or speculative purposes. We

did not apply hedge accounting to these swaps, therefore the gains and losses due to changes in fair value were

reported in other income (expense), net in our consolidated statements of operations.

For the year ended December 31, 2009, we recognized a net loss of $7.0 million on undesignated swap

contracts. During the fourth quarter of 2009, we terminated the swap contracts and paid the swap counterparties

$18.4 million which consisted of $14.7 million mark to market losses and $3.7 million accrued interest.

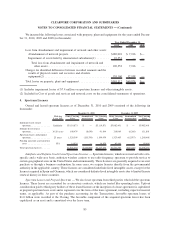

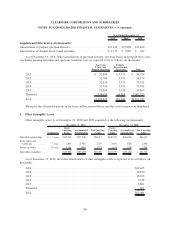

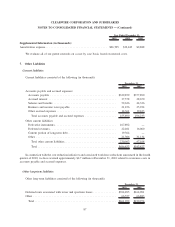

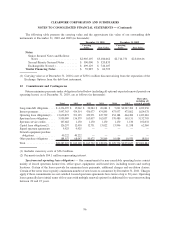

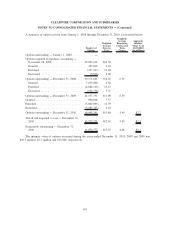

11. Fair Value

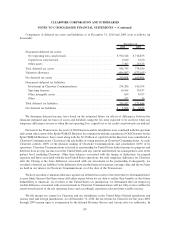

The following is a description of the valuation methodologies and pricing assumptions we used for financial

instruments measured and recorded at fair value on a recurring basis in our financial statements and the

classification of such instruments pursuant to the valuation hierarchy.

Cash Equivalents and Investments

Where quoted prices for identical securities are available in an active market, we use quoted market prices to

determine the fair value of investment securities and cash equivalents, and they are classified in Level 1 of the

valuation hierarchy. Level 1 securities include U.S. Government and Agency Issues and money market mutual

funds for which there are quoted prices in active markets.

For other debt securities which are classified in Level 3, we use discounted cash flow models to estimate the

fair value using various methods including the market and income approaches. In developing these models, we

utilize certain assumptions that market participants would use in pricing the investment, including assumptions

about risk and the risks inherent in the inputs to the valuation technique. We maximize the use of observable inputs

93

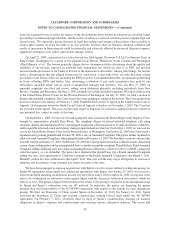

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)