Clearwire 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

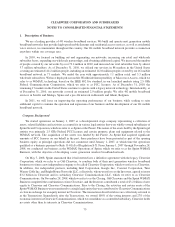

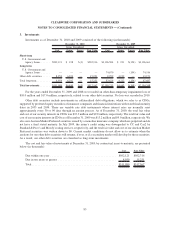

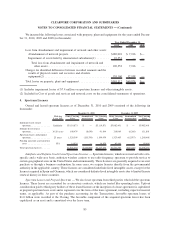

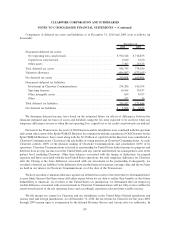

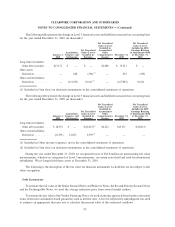

We incurred the following losses associated with property, plant and equipment for the years ended Decem-

ber 31, 2010, 2009 and 2008 (in thousands):

2010 2009 2008

Year Ended December 31,

Loss from abandonment and impairment of network and other assets:

Abandonment of network projects.......................... $180,001 $ 7,916 $—

Impairment of assets held by international subsidiaries(1) ........ 10,351 — —

Total loss from abandonment and impairment of network and

other assets ....................................... 190,352 7,916 —

Charges for identified differences between recorded amounts and the

results of physical counts and excessive and obsolete

equipment(2) ......................................... 159,160 52,958 —

Total losses on property, plant and equipment ................... $349,512 $60,874 $—

(1) Includes impairment losses of $7.4 million on spectrum licenses and other intangible assets.

(2) Included in Cost of goods and services and network costs on the consolidated statements of operations.

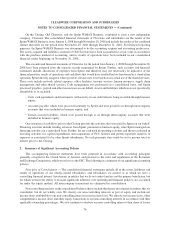

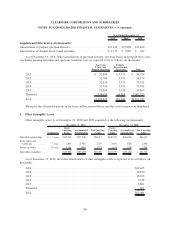

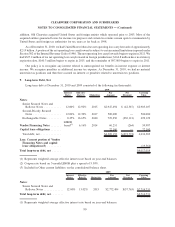

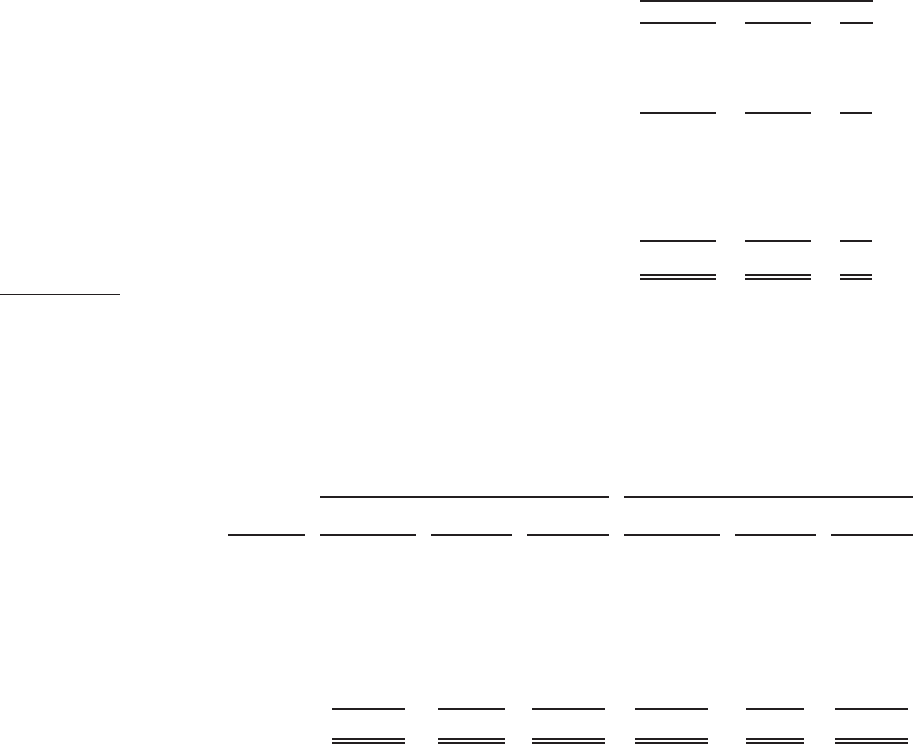

5. Spectrum Licenses

Owned and leased spectrum licenses as of December 31, 2010 and 2009 consisted of the following (in

thousands):

Wtd Avg

Lease Life

Gross Carrying

Value

Accumulated

Amortization

Net Carrying

Value

Gross Carrying

Value

Accumulated

Amortization

Net Carrying

Value

December 31, 2010 December 31, 2009

Indefinite-lived owned

spectrum . . . ........... Indefinite $3,110,871 $ — $3,110,871 $3,082,401 $ — $3,082,401

Definite-lived owned

spectrum . . . ........... 16-20 years 100,474 (8,630) 91,844 118,069 (6,268) 111,801

Spectrum leases and prepaid

spectrum . . . ........... 25years 1,320,309 (120,370) 1,199,939 1,323,405 (62,937) 1,260,468

Pending spectrum and transition

costs ................ N/A 14,838 — 14,838 40,464 — 40,464

Total spectrum licenses ...... $4,546,492 $(129,000) $4,417,492 $4,564,339 $(69,205) $4,495,134

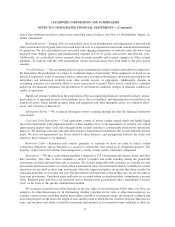

Indefinite and Definite-lived Owned Spectrum Licenses — Spectrum licenses, which are issued on both a site-

specific and a wide-area basis, authorize wireless carriers to use radio frequency spectrum to provide service to

certain geographical areas in the United States and internationally. These licenses are generally acquired as an asset

purchase or through a business combination. In some cases, we acquire licenses directly from the governmental

authority in the applicable country. These licenses are considered indefinite-lived intangible assets, except for the

licenses acquired in Spain and Germany, which are considered definite-lived intangible assets due to limited license

renewal history in these countries.

Spectrum Leases and Prepaid Spectrum — We also lease spectrum from third parties who hold the spectrum

licenses. These leases are accounted for as executory contracts, which are treated like operating leases. Upfront

consideration paid to third-party holders of these leased licenses at the inception of a lease agreement is capitalized

as prepaid spectrum lease costs and is expensed over the term of the lease agreement, including expected renewal

terms, as applicable. As part of the purchase accounting for the Transactions, favorable spectrum leases of

$1.0 billion were recorded at the Closing. The favorable component of the acquired spectrum leases has been

capitalized as an asset and is amortized over the lease term.

85

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)