Clearwire 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

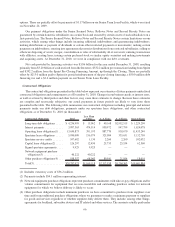

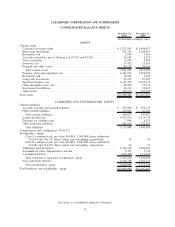

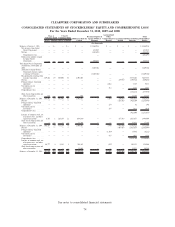

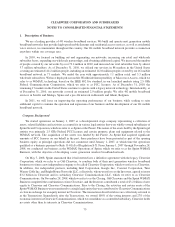

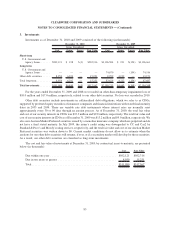

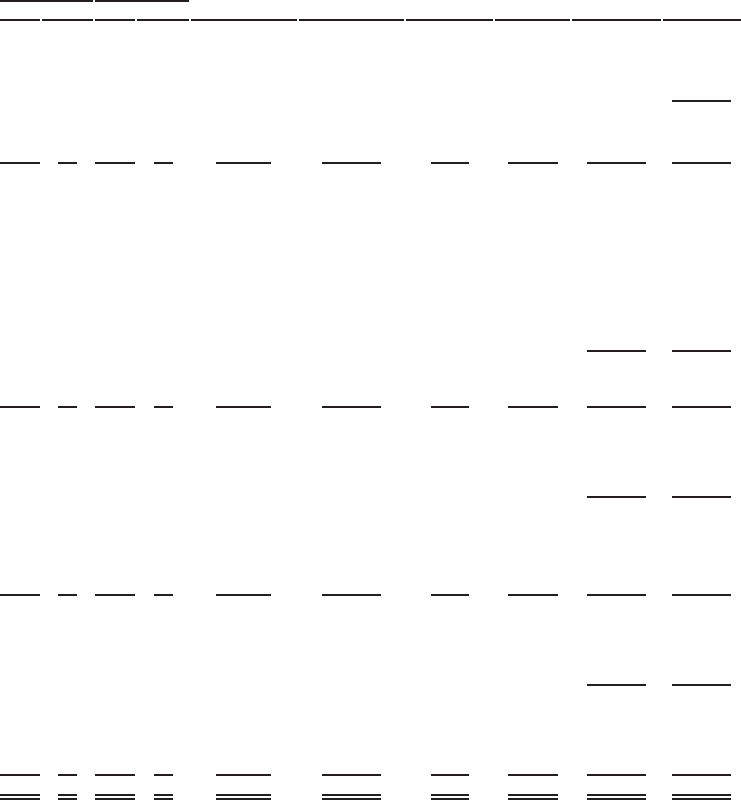

CLEARWIRE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE LOSS

For the Years Ended December 31, 2010, 2009 and 2008

Shares Amounts Shares Amounts

Class A

Common Stock

Class B

Common Stock Additional Paid In

Capital

Business Equity of

Sprint WiMAX

Business

Accumulated

Other

Comprehensive

Income

Accumulated

Deficit

Non-controlling

Interests

Total

Stockholders’

Equity

(In thousands)

Balances at January 1, 2008. . . . — $— — $— $ — $ 2,464,936 $ — $ — $ — $ 2,464,936

Net advances from Sprint

Nextel Corporation . . . . . . — — — — — 451,925 — — — 451,925

Net loss . . . . . . . . . . . . . — — — — — (402,693) — — — (402,693)

Comprehensive loss . . . . . — (402,693)

Deferred tax liability retained

by Sprint Nextel

Corporation . . . . . . . . . . — — — — — 755,018 — — — 755,018

Total Sprint Nextel Corporation

contribution at November 28,

2008 . . . . . . . . . . . . . . . — — — — — 3,269,186 — — — 3,269,186

Allocation of Sprint Nextel

Corporation business equity

at closing to Clearwire . . . . — — — — — (3,269,186) — — — (3,269,186)

Recapitalization resulting from

strategic transaction . . . . . 189,484 19 505,000 51 2,092,005 — — — 5,575,480 7,667,555

Net loss . . . . . . . . . . . . . — — — — — — — (29,933) (159,721) (189,654)

Foreign currency translation

adjustment . . . . . . . . . . — — — — — — 2,682 — 7,129 9,811

Unrealized gain on

investments . . . . . . . . . . — — — — — — 512 — 1,361 1,873

Comprehensive loss . . . . . . .

(151,231) (177,970)

Share-based compensation and

other transactions . . . . . . . 518 — — — 856 — — — 12,369 13,225

Balances at December 31, 2008 . . 190,002 19 505,000 51 2,092,861 — 3,194 (29,933) 5,436,618 7,502,810

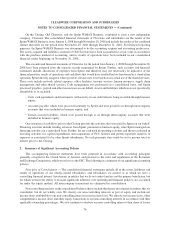

Net loss . . . . . . . . . . . . . — — — — — — (325,582) (928,264) (1,253,846)

Foreign currency translation

adjustment . . . . . . . . . . — — — — — — 254 — 42 296

Unrealized gain on

investments . . . . . . . . . . — — — — — — 297 — 1,622 1,919

Comprehensive loss . . . . . . .

(926,600) (1,251,631)

Issuance of common stock, net

of issuance costs, and other

capital transactions . . . . . . 6,765 1 229,239 22 (104,148) — — (57,541) 1,655,675 1,494,009

Share-based compensation and

other transactions . . . . . . . — — — — 11,348 — — — 15,832 27,180

Balances at December 31, 2009 . . 196,767 20 734,239 73 2,000,061 — 3,745 (413,056) 6,181,525 7,772,368

Net loss . . . . . . . . . . . . . — — — — — — (487,437) (1,815,657) (2,303,094)

Foreign currency translation

adjustment . . . . . . . . . . — — — — — — (1,180) — (5,042) (6,222)

Unrealized gain on

investments . . . . . . . . . . — — — — — — 437 — 1,917 2,354

Comprehensive loss . . . . . . . (1,818,782) (2,306,962)

Issuance of common stock, net

of issuance costs, and other

capital transactions . . . . . . 46,777 4 9,242 1 208,385 — (507) — 150,123 358,006

Share-based compensation and

other transactions . . . . . . . — — — — 12,664 — — — 33,922 46,586

Balances at December 31, 2010. . 243,544 $24 743,481 $74 $2,221,110 $ — $ 2,495 $(900,493) $ 4,546,788 $ 5,869,998

See notes to consolidated financial statements

74