Clearwire 2010 Annual Report Download - page 86

Download and view the complete annual report

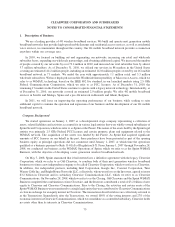

Please find page 86 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest Capitalization — We capitalize interest related to our owned spectrum licenses and the related

construction of our network infrastructure assets, as well as the development of software for internal use.

Capitalization of interest commences with pre-construction period administrative and technical activities, which

includes obtaining leases, zoning approvals and building permits, and ceases when the construction is substantially

complete and available for use or when we suspend substantially all construction activity. Interest is capitalized on

construction in progress, software under development and spectrum licenses accounted for as intangible assets with

indefinite useful lives. Interest capitalization is based on rates applicable to borrowings outstanding during the

period and the balance of qualified assets under construction during the period. Capitalized interest is reported as a

cost of the network assets or software assets and depreciated over the useful lives of those assets.

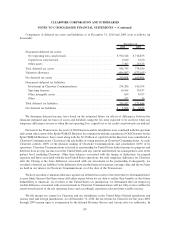

Income Taxes — We record deferred income taxes based on the estimated future tax effects of differences

between the financial statement and tax basis of assets and liabilities using the tax rates expected to be in effect

when the temporary differences reverse. Deferred tax assets are also recorded for net operating loss, capital loss, and

tax credit carryforwards. Valuation allowances, if any, are recorded to reduce deferred tax assets to the amount

considered more likely than not to be realized. We also apply a recognition threshold that a tax position is required

to meet before being recognized in the financial statements.

Revenue Recognition — We primarily earn revenue by providing access to our high-speed wireless networks.

Also included in revenue are leases of CPE and additional add-on services, including personal and business email

and static Internet Protocol. Revenue from retail subscribers is billed one month in advance and recognized ratably

over the contracted service period. Revenues associated with the sale of CPE and other equipment to subscribers is

recognized when title and risk of loss is transferred to the subscriber. Shipping and handling costs billed to

subscribers are classified as revenue. Activation fees charged to the subscriber are deferred and recognized as

revenues on a straight-line basis over the average estimated life of the subscriber relationship of 3 years.

Revenue from wholesale subscribers is billed one month in arrears and recognized ratably over the contracted

service period. Revenues are generally recognized based on terms defined in our commercial agreements with our

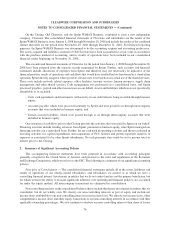

wholesale partners. We are currently engaged in ongoing negotiations with Sprint to resolve issues related to

wholesale pricing under our commercial agreements. See Note 12, Commitments and Contingencies, for further

information. As a result, the amount of revenue recognized during 2010 related to Sprint wholesale arrangements is

based on pricing proposed by Sprint. We expect to collect the revenue recognized to date.

Revenue arrangements with multiple deliverables are divided into separate units of accounting based on the

deliverables’ relative fair values if there is objective and reliable evidence of fair value for all deliverables in the

arrangement. When we are the primary obligor in a transaction, are subject to inventory risk, have latitude in

establishing prices and selecting suppliers, or have several but not all of these indicators, gross revenue is recorded.

If we are not the primary obligor and amounts earned are determined using a fixed percentage, a fixed-payment

schedule, or a combination of the two, we record the net amounts as commissions earned. Promotional discounts

treated as cash consideration are recorded as a reduction of revenue.

Advertising Costs — Advertising costs are expensed as incurred or the first time the advertising occurs.

Advertising expense was $213.9 million, $99.1 million and $7.5 million for the years ended December 31, 2010,

2009 and 2008, respectively.

Research and Development — Research and development costs are expensed as incurred and primarily relate

to costs incurred while assessing how external devices perform on our networks. Research and development

expense was $7.0 million, $6.4 million and $350,000 for the years ended December 31, 2010, 2009 and 2008,

respectively.

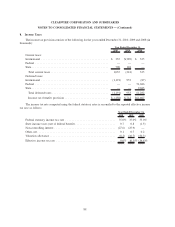

Net Loss per Share — Basic net loss per Class A Common Share is computed by dividing net loss attributable

to Clearwire Corporation by the weighted-average number of Class A Common Shares outstanding during the

81

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)