Clearwire 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

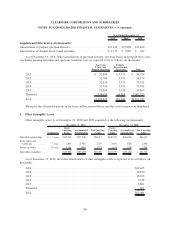

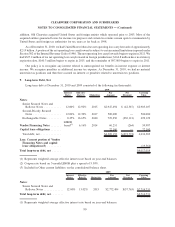

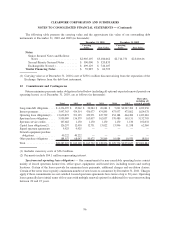

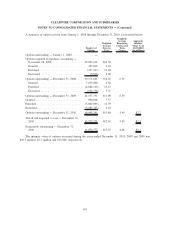

The following table presents the carrying value and the approximate fair value of our outstanding debt

instruments at December 31, 2010 and 2009 (in thousands):

Carrying

Value Fair Value

Carrying

Value Fair Value

December 31, 2010 December 31, 2009

Notes:

Senior Secured Notes and Rollover

Notes ......................... $2,905,107 $3,180,662 $2,714,731 $2,810,616

Second-Priority Secured Notes ........ $ 500,000 $ 520,833

Exchangeable Notes(1) .............. $ 499,129 $ 746,107

Vendor Financing Notes .............. $ 59,987 $ 60,793

(1) Carrying value as of December 31, 2010 is net of $230.1 million discount arising from the separation of the

Exchange Options from the debt host instrument.

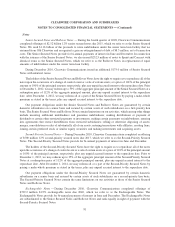

12. Commitments and Contingencies

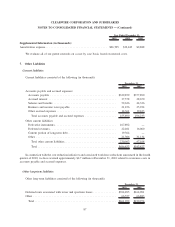

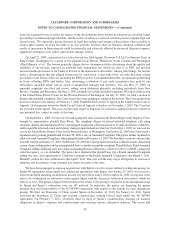

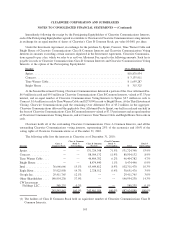

Future minimum payments under obligations listed below (including all optional expected renewal periods on

operating leases) as of December 31, 2010, are as follows (in thousands):

Total 2011 2012 2013 2014 2015

Thereafter,

including all

renewal periods

Long-term debt obligations . . . . $ 4,236,995 $ 15,062 $ 20,084 $ 20,084 $ 5,021 $2,947,494 $ 1,229,250

Interest payments . . . . . . . . . . . 3,997,363 474,514 476,077 474,895 473,937 473,862 1,624,078

Operating lease obligations(1) . . 13,630,873 391,193 439,971 447,799 454,188 464,482 11,433,240

Spectrum lease obligations . . . . 5,950,009 156,579 163,057 162,037 170,480 165,151 5,132,705

Spectrum service credits . . . . . . 107,682 1,130 1,130 1,130 1,130 1,130 102,032

Capital lease obligations(2) . . . . 126,297 12,450 12,731 13,022 13,996 11,538 62,560

Signed spectrum agreements . . . 9,925 9,925 ———— —

Network equipment purchase

obligations . . . . . . . . . . . . . . 40,222 40,222 ———— —

Other purchase obligations . . . . 188,557 68,043 50,672 29,869 10,984 10,970 18,019

Total . . . . . . . . . . . . . . . . . . . . $28,287,923 $1,169,118 $1,163,722 $1,148,836 $1,129,736 $4,074,627 $19,601,884

(1) Includes executory costs of $36.2 million.

(2) Payments include $54.1 million representing interest.

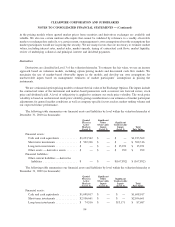

Spectrum and operating lease obligations — Our commitments for non-cancelable operating leases consist

mainly of leased spectrum license fees, office space, equipment, and leased sites, including towers and rooftop

locations. Certain of the leases provide for minimum lease payments, additional charges and escalation clauses.

Certain of the tower leases specify a minimum number of new leases to commence by December 31, 2011. Charges

apply if these commitments are not satisfied. Leased spectrum agreements have terms of up to 30 years. Operating

leases generally have initial terms of five years with multiple renewal options for additional five-year terms totaling

between 20 and 25 years.

96

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)