Clearwire 2010 Annual Report Download - page 85

Download and view the complete annual report

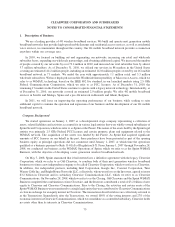

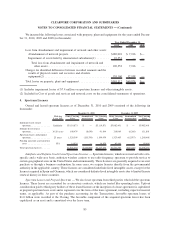

Please find page 85 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Spectrum Licenses — Spectrum licenses primarily include owned spectrum licenses with indefinite lives,

owned spectrum licenses with definite lives, and favorable spectrum leases. Indefinite lived spectrum licenses

acquired are stated at cost and are not amortized. While owned spectrum licenses in the United States are issued for

a fixed time, renewals of these licenses have occurred routinely and at nominal cost. Moreover, we have determined

that there are currently no legal, regulatory, contractual, competitive, economic or other factors that limit the useful

lives of our owned spectrum licenses and therefore, the licenses are accounted for as intangible assets with

indefinite lives. The impairment test for intangible assets with indefinite useful lives consists of a comparison of the

fair value of an intangible asset with its carrying amount. If the carrying amount of an intangible asset exceeds its

fair value, an impairment loss will be recognized in an amount equal to that excess. The fair value is determined by

estimating the discounted future cash flows that are directly associated with, and that are expected to arise as a direct

result of the use and eventual disposition of, the asset. Spectrum licenses with indefinite useful lives are assessed for

impairment annually, or more frequently, if an event indicates that the asset might be impaired. Internationally, we

recorded an impairment charge of $2.6 million during the year ended December 31, 2010 related to our indefinite-

lived spectrum assets in Ireland in conjunction with our sale of those operations. Other than the Ireland impairment,

we had no other impairment of our indefinite lived intangible assets in any of the periods presented.

Spectrum licenses with definite useful lives and favorable spectrum leases are stated at cost, net of accu-

mulated amortization, and are assessed for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable. The carrying value of the definite lived licenses and

spectrum leases are amortized on a straight-line basis over their estimated useful lives or lease term, including

expected renewal periods, as applicable. There were no impairment losses for spectrum licenses with definite useful

lives and favorable spectrum leases in the years ended December 31, 2010, 2009 and 2008.

Other Intangible Assets — Other intangible assets consist of subscriber relationships, trademarks, patents and

other, and are stated at cost net of accumulated amortization. Amortization is calculated using either the straight-

line method or an accelerated method over the assets’ estimated remaining useful lives. Other intangible assets are

assessed for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset

may not be recoverable. For the year ended December 31, 2010, we recorded impairment losses of $1.5 million

relating to our definite-lived intangible assets in Ireland in conjunction with our sale of those operations. There were

no impairment losses for our other intangible assets in the years ended December 31, 2009 and 2008.

Derivative Instruments and Hedging Activities — In the normal course of business, we may be exposed to the

effects of interest rate changes. We have limited our exposure by adopting established risk management policies and

procedures, including the use of derivative instruments. It is our policy that derivative transactions are executed only

to manage exposures arising in the normal course of business and not for the purpose of creating speculative

positions or trading. We record all derivatives on the balance sheet at fair value as either assets or liabilities. The

accounting for changes in the fair value of derivatives depends on the intended use of the derivative and whether it

qualifies for hedge accounting.

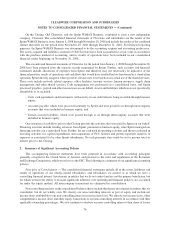

During December 2010, we issued exchangeable notes that included embedded exchange options which

qualified as embedded derivative instruments that are required to be accounted for separately from the host debt

instruments and recorded as derivative financial instruments at fair value. The embedded exchange options do not

qualify for hedge accounting, and as such, all future changes in the fair value of these derivative instruments will be

recognized currently in earnings until such time as the embedded exchange options are exercised or expire. See

Note 10, Derivative Instruments, for further information.

Debt Issuance Costs — Debt issuance costs are initially capitalized as a deferred cost and amortized to interest

expense under the effective interest method over the expected term of the related debt. Unamortized debt issuance

costs related to extinguishment of debt are expensed at the time the debt is extinguished and recorded in other

income (expenses), net in the consolidated statements of operations. Unamortized debt issuance costs are recorded

in other assets in the consolidated balance sheets.

80

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)