Clearwire 2010 Annual Report Download - page 97

Download and view the complete annual report

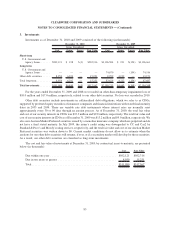

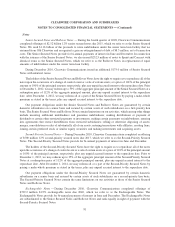

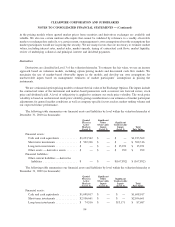

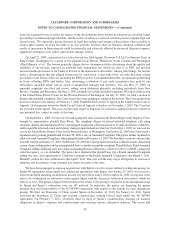

Please find page 97 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The holders of the Exchangeable Notes have the right to exchange their notes for Clearwire Corporation’s

Class A common stock, which we refer to as Class A Common Stock, at any time, prior to the maturity date. We

have the right to settle the exchange by delivering cash or shares of Class A Common Stock, subject to certain

conditions. The initial exchange rate for each note is 141.2429 shares per $1,000 note, equivalent to an initial

exchange price of approximately $7.08 per share, subject to adjustments upon the occurrence of certain corporate

events. Upon exchange, we will not make additional cash payment or provide additional shares for accrued or

unpaid interest, make-whole premium or additional interest.

The holders of the Exchangeable Notes have the right to require us to repurchase all of the notes upon the

occurrence of a fundamental change event at a price of 100% of the principal amount plus any unpaid accrued

interest to the repurchase date. The holders who elect to exchange the Exchangeable Notes in connection with the

occurrence of a fundamental change will be entitled to additional shares that are specified based on the date on

which such event occurs and the price paid per share of Class A Common Stock in the fundamental change, with a

maximum number of shares issuable per note not to exceed 169.4915 shares. The holders of the Exchangeable

Notes have the option to require us to repurchase for cash the Exchangeable Notes on December 1, 2017, 2025, 2030

and 2035 at a price equal to 100% of the principal amount of the notes plus any unpaid accrued interest to the

repurchase date. On or after December 1, 2017, we may, at our option, redeem all or part of the Exchangeable Notes

at a price equal to 100% of the principal amount of the notes plus any unpaid accrued interest to the redemption date.

Our payment obligations under the Exchangeable Notes are guaranteed by certain domestic subsidiaries in the

same priority as the Second-Priority Secured Notes.

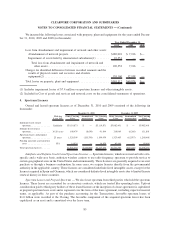

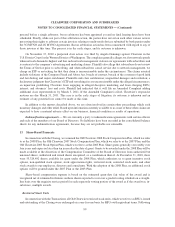

Upon issuance of the Exchangeable Notes, we recognized a derivative liability representing the embedded

exchange feature with an estimated fair value of $231.5 million and an associated debt discount on the

Exchangeable Notes. The discount is accreted over the expected life, approximately 7 years, of the Exchangeable

Notes using the effective interest rate method. See Note 10, Derivative Instruments, for additional discussion of the

derivative liability.

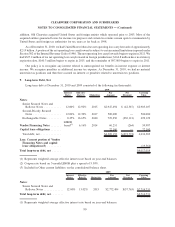

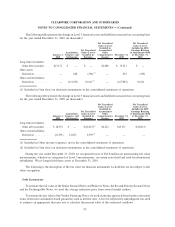

Vendor Financing Notes

During 2010, we entered into a vendor financing facility allowing us to obtain up to $160.0 million of financing

by entering into notes, which we refer to as Vendor Financing Notes, until January 31, 2011. The Vendor Financing

Notes have a coupon rate based on the 3-month LIBOR plus a spread of 5.50% which are due quarterly and mature

in 2014. We utilized $60.3 million of this vendor financing facility in 2010.

On January 31, 2011, the vendor financing facility was amended to allow us to obtain up to an additional

$95.0 million of financing until January 31, 2012. The coupon rate and terms of the notes under the amended facility

are identical to those of the original Vendor Financing Notes except that they mature in 2015.

Capital Lease Obligations

During 2010, we have entered into capital lease facilities which allow us to obtain up to $99.0 million of

financing with 4 year terms, until August 16, 2011. In addition, we also lease certain network construction

equipment under capital leases with 12 year lease terms.

As of December 31, 2010, approximately $132.4 million of our outstanding debt, comprised of Vendor

Financing Notes and capital lease obligations, is secured by assets classified as network and base station equipment.

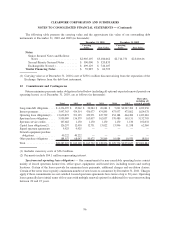

Future Payments — For future payments on our long-term debt see Note 12, Commitments and

Contingencies.

92

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)