Clearwire 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

options. These are partially offset by payments of $1.17 billion on our Senior Term Loan Facility, which was retired

on November 24, 2009.

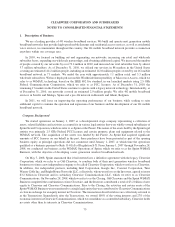

Our payment obligations under the Senior Secured Notes, Rollover Notes and Second Priority Notes are

guaranteed by certain domestic subsidiaries on a senior basis and secured by certain assets of such subsidiaries on a

first-priority lien. The Senior Secured Notes, Rollover Notes and Second Priority Notes contain limitations on our

activities, which among other things include incurring additional indebtedness and guaranteeing indebtedness;

making distributions or payment of dividends or certain other restricted payments or investments; making certain

payments on indebtedness; entering into agreements that restrict distributions from restricted subsidiaries; selling or

otherwise disposing of assets; merger, consolidation or sales of substantially all of our assets; entering transactions

with affiliates; creating liens; issuing certain preferred stock or similar equity securities and making investments

and acquiring assets. At December 31, 2010, we were in compliance with our debt covenants.

Net cash provided by financing activities was $3.86 billion for the year ended December 31, 2008, resulting

primarily from $3.20 billion of cash received from the Investors, $532.2 million pre-transaction funding from Sprint

and $392.2 million from the Sprint Pre-Closing Financing Amount, up through the Closing. These are partially

offset by $213.0 million paid to Sprint for partial reimbursement of the pre-closing financing, a $50.0 million debt

financing fee and a $3.6 million payment on our Senior Term Loan Facility.

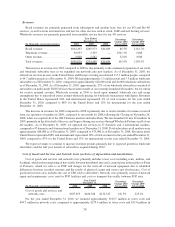

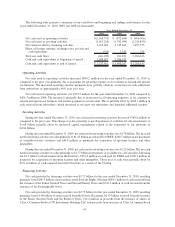

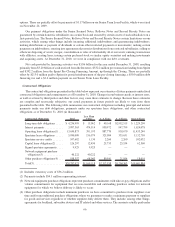

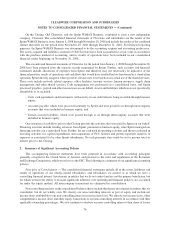

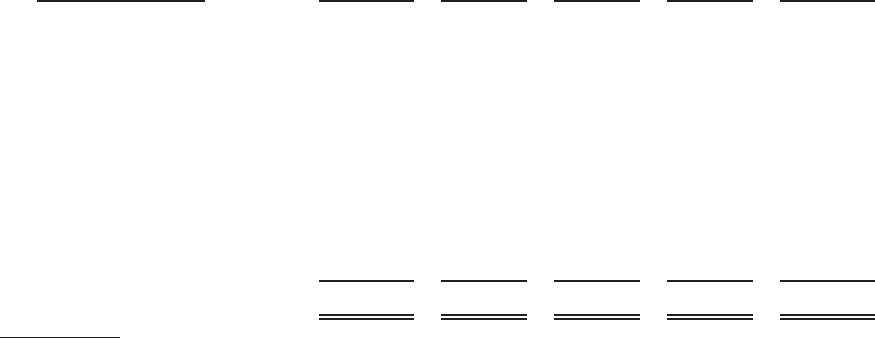

Contractual Obligations

The contractual obligations presented in the table below represent our estimates of future payments under fixed

contractual obligations and commitments as of December 31, 2010. Changes in our business needs or interest rates,

as well as actions by third parties and other factors, may cause these estimates to change. Because these estimates

are complex and necessarily subjective, our actual payments in future periods are likely to vary from those

presented in the table. The following table summarizes our contractual obligations including principal and interest

payments under our debt obligations, payments under our spectrum lease obligations, and other contractual

obligations as of December 31, 2010 (in thousands):

Contractual Obligations Total

Less Than

1 Year 1 - 3 Years 3 - 5 Years Over 5 Years

Long-term debt obligations . . . . . $ 4,236,995 $ 15,062 $ 40,168 $2,952,515 $ 1,229,250

Interest payments . . . . . . . . . . . . 3,997,363 474,514 950,972 947,799 1,624,078

Operating lease obligations(1) . . . 13,630,873 391,193 887,770 918,670 11,433,240

Spectrum lease obligations . . . . . 5,950,009 156,579 325,094 335,631 5,132,705

Spectrum service credits . . . . . . . 107,682 1,130 2,260 2,260 102,032

Capital lease obligations(2) . . . . . 126,297 12,450 25,753 25,534 62,560

Signed spectrum agreements . . . . 9,925 9,925 — — —

Network equipment purchase

obligations(3) . . . . . . . . . . . . . 40,222 40,222 — — —

Other purchase obligations(4) . . . 188,557 68,043 80,541 21,954 18,019

Total(5) . . . . . . . . . . . . . . . . . . . $28,287,923 $1,169,118 $2,312,558 $5,204,363 $19,601,884

(1) Includes executory costs of $36.2 million.

(2) Payments include $54.1 million representing interest.

(3) Network equipment purchase obligations represent purchase commitments with take-or-pay obligations and/or

volume commitments for equipment that are non-cancelable and outstanding purchase orders for network

equipment for which we believe delivery is likely to occur.

(4) Other purchase obligations include minimum purchases we have committed to purchase from suppliers over

time and/or unconditional purchase obligations where we guarantee to make a minimum payment to suppliers

for goods and services regardless of whether suppliers fully deliver them. They include, among other things,

agreements for backhaul, subscriber devices and IT related and other services. The amounts actually paid under

66