Clearwire 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.incentives, such as gift cards, discounted devices and reduced introductory rate plans, in order to attract new

subscribers. We may seek out and implement co-branding advertising and/or marketing opportunities with our

wholesale partners, equipment vendors, and other telecommunication and media companies.

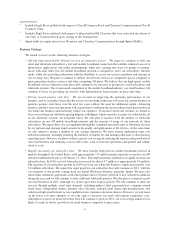

Wholesale Distribution

We have wholesale agreements with Sprint, Comcast, Time Warner Cable, Bright House, Best Buy and

CBeyond. These agreements provide us with significant additional distribution channels for our services. Under

these agreements, our wholesale partners are permitted to market and resell wireless broadband services over our

network to their end user subscribers. Currently all of our Initial Wholesale Partners have begun offering, or have

announced plans to offer, our 4G mobile broadband services. Sprint offers our services in all 71 of our 4G markets,

including among others New York, Los Angeles, San Francisco, Philadelphia, Chicago, Atlanta, Seattle, Dallas, and

Las Vegas. Comcast offers our services in 37 markets including Chicago, Philadelphia, Houston, Atlanta,

Washington D.C., Miami, and Seattle. Time Warner Cable offers our service in 20 markets including New York,

Los Angeles, Dallas, San Antonio and Charlotte. Any purchasers of 4G mobile broadband services through these

agreements remain subscribers of our Initial Wholesale Partners, but we are entitled to receive payment directly

from our Initial Wholesale Partners for providing the 4G mobile broadband services to those subscribers. We have

also entered into agreements with new wholesale partners Best Buy and CBeyond, each of which we expect to begin

offering our services in 2011. In addition to our wholesale agreements with our current wholesale partners, we are

currently seeking to enter into other wholesale agreements with other third parties.

The success of our current plans will depend to a large extent on whether we succeed in growing our wholesale

subscriber base and generating the revenue levels we currently expect for that portion of our business. Our

wholesale business is subject to a number of uncertainties, such as the pricing disputes with our largest wholesale

partner, Sprint, which are described in more detail below in “Risk Factors — We are currently involved in pricing

disputes with Sprint relating to 4G usage by Sprint under our commercial agreements, and if the disputes are not

resolved favorably to us, it could materially adversely affect our business prospects and results of operations and/or

require us to revise our current business plans” and “Risk Factors — We expect the future revenues generated from

our wholesale partner agreements to become an increasingly larger percentage of our overall revenues, and if we do

not receive the amount of revenues we expect from those agreements it could materially and adversely affect our

business prospects, results of operations and financial condition, and/or require us to revise our current business

plans.”

Retail Distribution Channels

Although our current plans contemplate a reduction in spending related to our retail services, we plan to

continue to use multiple distribution channels to reach potential subscribers, including:

National and Local Indirect

Our indirect sales channels include a variety of authorized representatives, such as traditional cellular retailers,

consumer electronics stores, satellite television dealers and computer sales and repair stores. These authorized

representatives typically operate retail stores but, subject to our approval, can also extend their sales efforts online.

Authorized representatives assist in developing awareness of and demand for our service by promoting our services

and brand as part of their own advertising and direct marketing campaigns. We also offer our services pursuant to

distribution agreements through national retail chains, such as Best Buy and Radio Shack, and we believe that the

percentage of our total sales from this indirect sales channel will continue to increase.

Internet and Telephone Sales

In our advertising and marketing materials, we direct prospective subscribers to our website or our telesales

centers in our advertising. As part of our cost savings initiatives, our internet and telephone sales will become a

more component of our distribution channels during 2011. Our website is a fully functional sales channel where

subscribers can check pricing and service availability, view coverage maps, research rate plan features and device

10