Clearwire 2010 Annual Report Download - page 72

Download and view the complete annual report

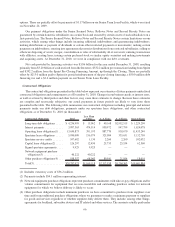

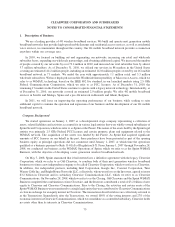

Please find page 72 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.some of these “other” agreements will likely be higher than the minimum commitments due to variable

components of these agreements. The more significant variable components that determine the ultimate

obligation owed include hours contracted, subscribers and other factors.

(5) In addition, we are party to various arrangements that are conditional in nature and create an obligation to make

payments only upon the occurrence of certain events, such as the actual delivery and acceptance of products or

services. Because it is not possible to predict the timing or amounts that may be due under these conditional

arrangements, no such amounts have been included in the table above. The table above also excludes blanket

purchase order amounts where the orders are subject to cancellation or termination at our discretion or where

the quantity of goods or services to be purchased or the payment terms are unknown because such purchase

orders are not firm commitments.

We do not have any obligations that meet the definition of an off-balance-sheet arrangement that have or are

reasonably likely to have a material effect on our financial statements.

Recent Accounting Pronouncements

In October 2009, the FASB issued new accounting guidance that amends the revenue recognition for multiple-

element arrangements and expands the disclosure requirements related to such arrangements. The new guidance

amends the criteria for separating consideration in multiple-deliverable arrangements, establishes a selling price

hierarchy for determining the selling price of a deliverable, eliminates the residual method of allocation, and

requires the application of relative selling price method in allocating the arrangement consideration to all

deliverables. The new accounting guidance is effective for fiscal years beginning after June 15, 2010. We will

adopt the new accounting guidance beginning January 1, 2011. We do not anticipate the adoption of the new

accounting guidance to have a significant effect on our financial condition or results of operations.

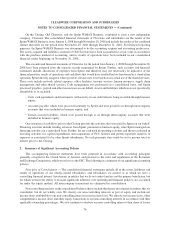

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk

Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates,

our stock price risk, foreign currency exchange rates and changes in the market value of investments due to credit

risk.

Interest Rate Risk

Our primary interest rate risk is associated with our cash equivalents and investment portfolio. We presently

invest primarily in money market mutual funds and United States Government and Agency Issues maturing

approximately 15 months or less from the date of purchase.

Our cash equivalent and investment portfolio has a weighted average maturity of 3.8 months and a market yield

of 0.09% as of December 31, 2010. Our primary interest rate risk exposure is to a decline in interest rates which

would result in a decline in interest income. Due to the current market yield, a further decline in interest rates would

have a de minimis impact on earnings.

We have long-term fixed-rate debt with a book value of $3.90 billion and $72.2 million of long-term fixed-rate

capital lease obligations outstanding at December 31, 2010. The fair value of the debt fluctuates as interest rates

change, however, there is no impact to earnings and cash flows as we expect to hold the debt, with the exception of

the Exchangeable Notes, to maturity unless market and other factors are favorable. The Exchangeable Notes, with a

carrying value of $499.1 million at December 31, 2010 and a maturity of 2040, are expected to be redeemed in

approximately 7 years given on December 1, 2017, the holders have the right to require us to repurchase the notes

and we have the right to redeem the notes.

We also have variable rate promissory notes which expose us to fluctuations in interest expense and payments

caused by changes in interest rates. At December 31, 2010, we had $60.3 million aggregate principal outstanding of

variable rate promissory notes whose interest rate resets quarterly based on the 3-month LIBOR rate. A 1% increase

in the 3-month LIBOR rate would increase interest expense over the next twelve month period by approximately

$502,000.

67