Clearwire 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

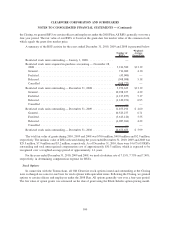

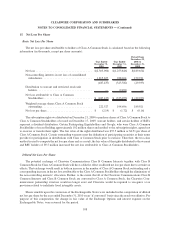

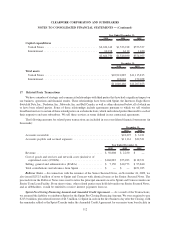

15. Net Loss Per Share

Basic Net Loss Per Share

The net loss per share attributable to holders of Class A Common Stock is calculated based on the following

information (in thousands, except per share amounts):

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Period From

November 29,

2008 to

December 31,

2008

Net loss .................................... $(2,303,094) $(1,253,846) $(189,654)

Non-controlling interests in net loss of consolidated

subsidiaries................................ 1,815,657 928,264 159,721

(487,437) (325,582) (29,933)

Distribution to warrant and restricted stock unit

holders ................................... — (9,491) —

Net loss attributable to Class A Common

Stockholders ............................... $ (487,437) $ (335,073) $ (29,933)

Weighted average shares Class A Common Stock

outstanding ................................ 222,527 194,696 189,921

Net loss per share ............................. $ (2.19) $ (1.72) $ (0.16)

The subscription rights we distributed on December 21, 2009 to purchase shares of Class A Common Stock to

Class A Common Stockholders of record on December 17, 2009, warrant holders, and certain holders of RSUs

represent a dividend distribution. Certain Participating Equityholders and Google, who were Class A Common

Stockholders of record holding approximately 102 million shares and entitled to the subscription rights, agreed not

to exercise or transfer their rights. The fair value of the rights distributed was $57.5 million or $0.51 per share of

Class A Common Stock. Certain outstanding warrants meet the definition of participating securities as their terms

provide for participation in distributions with Class A Common Stock prior to exercise. Therefore, the two-class

method is used to compute the net loss per share and as a result, the fair value of the rights distributed to the warrant

and RSU holders of $9.5 million increased the net loss attributable to Class A Common Stockholders.

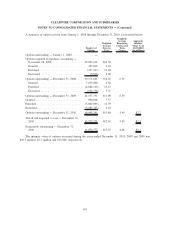

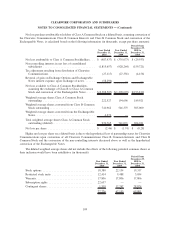

Diluted Net Loss Per Share

The potential exchange of Clearwire Communications Class B Common Interests together with Class B

Common Stock for Class A Common Stock will have a dilutive effect on diluted net loss per share due to certain tax

effects. That exchange would result in both an increase in the number of Class A Common Stock outstanding and a

corresponding increase in the net loss attributable to the Class A Common Stockholders through the elimination of

the non-controlling interests’ allocation. Further, to the extent that all of the Clearwire Communications Class B

Common Interests and Class B Common Stock are converted to Class A Common Stock, the Clearwire Com-

munications partnership structure would no longer exist and Clearwire would be required to recognize a tax

provision related to indefinite lived intangible assets.

Shares issuable upon the conversion of the Exchangeable Notes were included in the computation of diluted

net loss per share for the year ended December 31, 2010 on an “if converted” basis since the result was dilutive. For

purpose of this computation, the change in fair value of the Exchange Options and interest expense on the

Exchangeable Notes, were reversed for the period.

108

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)