Clearwire 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

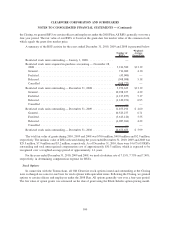

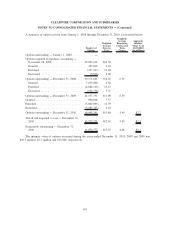

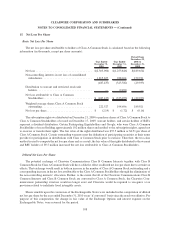

The contingent shares for the year ended December 31, 2010 relate to Clearwire Communications Class B

Common Interests and Clearwire Communications voting interests that were issued to Participating Equityholders

upon the Third Investment Closing, as such interests can be exchanged for Class A Common Stock.

The contingent shares for the year ended December 31, 2009, primarily relate to Clearwire Communications

Class B Common Interests and Clearwire Communications voting interests that were to be issued to Participating

Equityholders upon the Second and Third Investment Closings as such interests, on a combined basis, can be

exchanged for Class A Common Stock. The Second Investment Closing was December 21, 2009. The Third

Investment Closing was March 2, 2010.

The contingent shares for the year ended December 31, 2008, relate to purchase price share adjustment of

28,235,294 million shares of Class A Common Stock and equity issuance to CW Investment Holdings of

588,235 shares of Class A Common Stock, all of which were issued in February of 2009.

We have calculated and presented basic and diluted net loss per share of Class A Common Stock. Class B

Common Stock net loss per share is not calculated since it does not contractually participate in distributions of

Clearwire. Prior to the Closing, we had no equity as we were a wholly-owned division of Sprint. As such, we did not

calculate or present net loss per share for the period from January 1, 2008 to November 28, 2008.

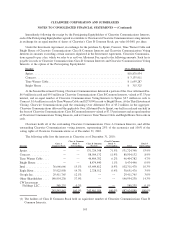

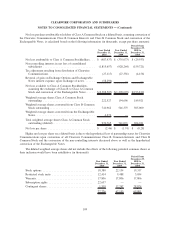

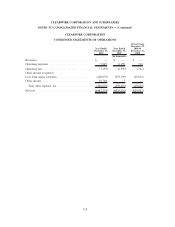

16. Business Segments

Information about operating segments is based on our internal organization and reporting of revenue and

operating income (loss) based upon internal accounting methods. Operating segments are defined as components of

an enterprise about which separate financial information is available that is evaluated regularly by the chief

operating decision maker, or decision making group, in deciding how to allocate resources and in assessing

performance. Our chief operating decision maker is our Chief Executive Officer. As of December 31, 2010, 2009

and 2008, we have identified two reportable segments: the United States and the international businesses.

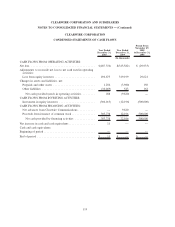

We report business segment information as follows (in thousands):

United States International Total

Year Ended December 31, 2010

Revenues:

Retail revenue .............................. $ 480,761 $ 21,532 $ 502,293

Wholesale revenue ........................... 50,593 — 50,593

Other revenue .............................. 3,749 191 3,940

Total revenues ............................ 535,103 21,723 556,826

Cost of goods and services and network costs

(exclusive of items shown separately below) ...... 912,774 14,681 927,455

Operating expenses .......................... 1,327,565 50,573 1,378,138

Depreciation and amortization .................. 453,966 12,146 466,112

Total operating expenses..................... 2,694,305 77,400 2,771,705

Operating loss .............................. $(2,159,202) $(55,677) (2,214,879)

Other income (expense), net ..................... (88,371)

Income tax benefit............................. 156

Net loss .................................... (2,303,094)

Non-controlling interest ......................... 1,815,657

Net loss attributable to Clearwire ................ $ (487,437)

110

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)