Clearwire 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

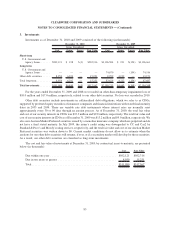

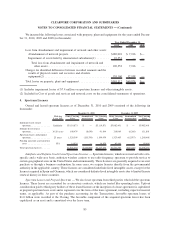

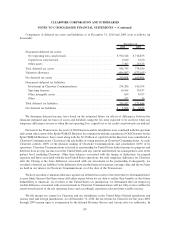

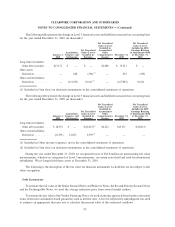

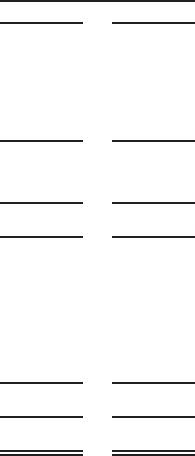

Components of deferred tax assets and liabilities as of December 31, 2010 and 2009 were as follows (in

thousands):

2010 2009

December 31,

Noncurrent deferred tax assets:

Net operating loss carryforward ............................... $932,818 $ 718,853

Capital loss carryforward. ................................... 6,620 6,230

Other assets ............................................. 7,307 13,573

Total deferred tax assets . . . ................................... 946,745 738,656

Valuation allowance ......................................... (696,887) (573,165)

Net deferred tax assets ....................................... 249,858 165,491

Noncurrent deferred tax liabilities:

Investment in Clearwire Communications........................ 238,286 142,434

Spectrum licenses ......................................... 16,164 19,437

Other intangible assets. . . ................................... 659 9,937

Other .................................................. 313 36

Total deferred tax liabilities . ................................... 255,422 171,844

Net deferred tax liabilities . . ................................... $ 5,564 $ 6,353

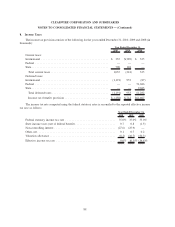

We determine deferred income taxes based on the estimated future tax effects of differences between the

financial statement and tax bases of assets and liabilities using the tax rates expected to be in effect when any

temporary differences reverse or when the net operating loss, capital loss or tax credit carryforwards are utilized.

Pursuant to the Transactions, the assets of Old Clearwire and its subsidiaries were combined with the spectrum

and certain other assets of the Sprint WiMAX Business. In conjunction with the acquisition of Old Clearwire by the

Sprint WiMAX Business, these assets along with the $3.2 billion of capital from the Investors were contributed to

Clearwire Communications. Clearwire is the sole holder of voting interests in Clearwire Communications. As such,

Clearwire controls 100% of the decision making of Clearwire Communications and consolidates 100% of its

operations. Clearwire Communications is treated as a partnership for United States federal income tax purposes and

therefore does not pay income tax in the United States and any current and deferred tax consequences arise at the

partner level, including Clearwire. Other than balances associated with the timing of deductions for prepaid

expenses and those associated with the non-United States operations, the only temporary difference for Clearwire

after the Closing is the basis difference associated with our investment in the partnership. Consequently, we

recorded a deferred tax liability for the difference between the financial statement carrying value and the tax basis

we hold in our interest in Clearwire Communications as of the date of the Transactions.

We have recorded a valuation allowance against our deferred tax assets to the extent that we determined that it

is more likely than not that these items will either expire before we are able to realize their benefits or that future

deductibility is uncertain. As it relates to the United States tax jurisdiction, we determined that our temporary

taxable difference associated with our investment in Clearwire Communications will not fully reverse within the

carryforward period of the net operating losses and accordingly represents relevant future taxable income.

We file income tax returns for Clearwire and our subsidiaries in the United States Federal jurisdiction and

various state and foreign jurisdictions. As of December 31, 2010, the tax returns for Clearwire for the years 2003

through 2009 remain open to examination by the Internal Revenue Service and various state tax authorities. In

89

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)