Clearwire 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with the issuance of the Exchangeable Notes in December 2010, we recognized a derivative

liability relating to the Exchange Options embedded in those notes with an estimated fair value at issuance of

$231.5 million. The change in estimated fair value is required to be recognized in earnings during the period. For the

year ended December 31, 2010, we recorded a gain of $63.6 million for the change in estimated fair value of the

Exchange Options. These instruments were not outstanding during 2009 and 2008. The $7.0 million and

$6.1 million losses recorded during the years ended December 31, 2009 and December 31, 2008, respectively,

were related to interest rate swap contracts which were used as economic hedges of the interest rate risk related to a

portion of our Senior Term Loan Facility. We terminated these swap contracts during the fourth quarter of 2009 in

connection with the retirement of our Senior Term Loan Facility.

We expect the gain (loss) on derivative instruments to fluctuate significantly in 2011 due to the sensitivity of

the estimated fair value of the Exchange Options to valuation inputs such as stock price and volatility. See Item 7A,

Quantitative and Qualitative Disclosures About Market Risk — Stock Price Risk.

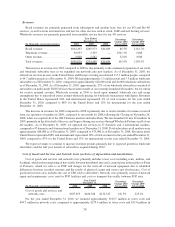

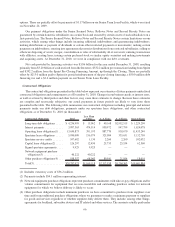

Other Income (Expense), Net

(In thousands, except percentages) 2010 2009 2008

Year Ended

December 31,

Other-than-temporary impairment loss on investments .......... $ — $(10,015) $(17,036)

Gain on debt extinguishment ............................ — 8,252 —

Other.............................................. (3,723) (1,275) 900

Total .............................................. $(3,723) $ (3,038) $(16,136)

For the year ended December 31, 2010, the other expense is primarily related to the losses from equity

investees, which was partially offset by gains from the disposition of certain foreign subsidiaries.

During 2009, we recorded an other-than-temporary impairment loss of $10.0 million on our other debt

securities. During the year ended December 31, 2008, we incurred other-than-temporary impairment losses of

$17.0 million related to these securities. We acquired our other debt securities as a result of the acquisition of Old

Clearwire on November 28, 2008.

During November 2009, we recorded a gain of $8.3 million in connection with the retirement of our Senior

Term Loan Facility and terminated the interest rate swap contracts.

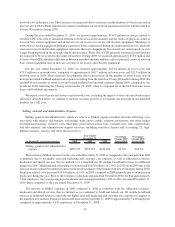

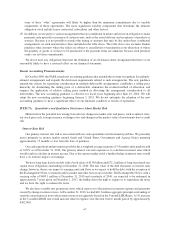

Income Tax Benefit (Provision)

(In thousands, except percentages) 2010 2009 2008

Year Ended

December 31,

Income tax benefit (provision) ............................... $156 $(712) $(61,607)

The decrease in the income tax provision for 2010 compared to 2009 is primarily due to the change in our

deferred tax position as a result of the disposition of certain foreign subsidiaries. These foreign subsidiaries had

deferred tax liabilities associated with their ownership of spectrum. Upon the sale of these subsidiaries, the amount

of deferred tax liability was reduced and a benefit obtained.

The significant decrease in the income tax provision for 2009 compared to 2008 is primarily due to the change

in our deferred tax position as a result of the Closing. Prior to the Closing, the income tax provision was primarily

due to increased deferred liabilities from additional amortization taken for federal income tax purposes by the

Sprint WiMAX Business on certain indefinite-lived licensed spectrum. As a result of the Closing, the only United

States temporary difference is the basis difference associated with our investment in Clearwire Communications, a

partnership for United States income tax purposes.

62