Clearwire 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Bright House held 8,474,440 shares of Class B Common Stock, representing approximately 0.9% of the

voting power of Clearwire, and an equivalent number of Clearwire Communications Class B Common

Units.

• Eagle River held 2,728,512 shares of Class B Common Stock and an equivalent number of Clearwire

Communications Class B Common Units, and 35,922,958 previously purchased shares of Class A Common

Stock, with the shares of Class A and Class B Common Stock together representing approximately 3.9% of

the voting power of Clearwire.

At the closing of the Transactions, Clearwire, Sprint, Eagle River and the Investors entered into the

Equityholders’ Agreement which sets forth certain rights and obligations of the parties with respect to the

governance of Clearwire, transfer restrictions on Class A Common Stock and Class B Common Stock, rights of first

refusal and pre-emptive rights, among other things. As the holders of nearly 85.6% of the total voting power of

Clearwire, Sprint, Eagle River and the Investors together effectively have control of Clearwire.

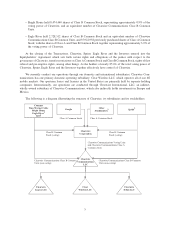

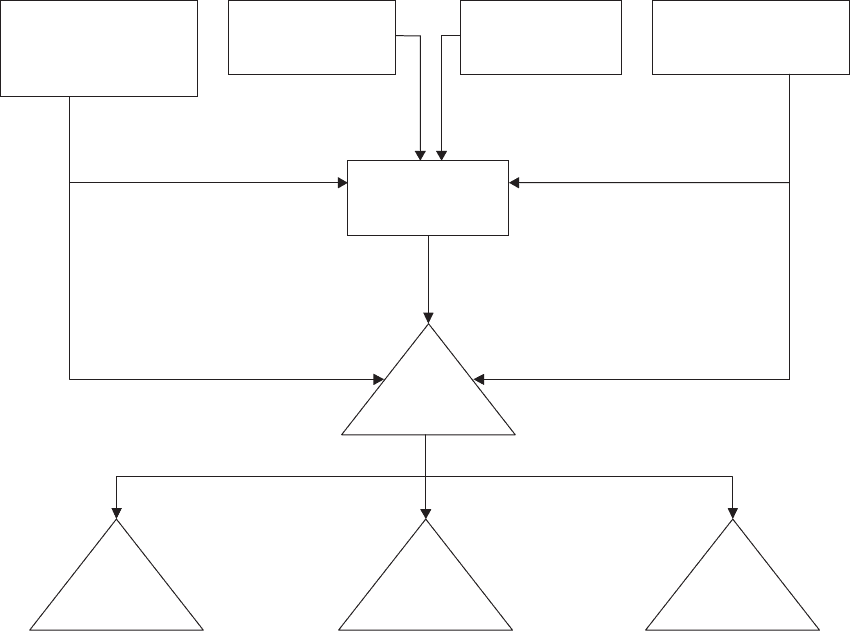

We currently conduct our operations through our domestic and international subsidiaries. Clearwire Com-

munications has one primary domestic operating subsidiary: Clear Wireless LLC, which operates all of our 4G

mobile markets. Our spectrum leases and licenses in the United States are primarily held by separate holding

companies. Internationally, our operations are conducted through Clearwire International, LLC, an indirect,

wholly-owned subsidiary of Clearwire Communications, which also indirectly holds investments in Europe and

Mexico.

The following is a diagram illustrating the structure of Clearwire, its subsidiaries and its stockholders:

Other

Stockholders2

Comcast

Time Warner Cable

Bright House

Eagle River1

Intel1

Sprint3

Clearwire

Communications

LLC

Clearwire

Corporation

Class A Common Stock

Class B Common

Stock (voting)

Clearwire Communications Class B Common

Units (non-voting)

Clearwire Communications Class B Common

Units (non-voting)

Class B Common

Stock (voting)

Google

Class A Common Stock

Clearwire Communications Voting Units

and Clearwire Communications Class A

Common Units

Clearwire

Xohm LLC

Clearwire

Legacy LLC

Clear

Wireless LLC

5