Clearwire 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

otherwise terminate to match another party’s offer to lease the same spectrum. Our leases are generally transferable,

assuming we obtain required governmental approvals.

We have BRS licenses and leases, as well as EBS leases, in a large number of markets across the United States.

We believe that our significant spectrum holdings, both in terms of spectrum depth and breadth, in the 2.5 GHz band

will be optimal for delivering our 4G mobile broadband services. As of December 31, 2010, we believe we were the

largest holder of licensed wireless spectrum in the United States. As of December 31, 2010, we owned or leased, or had

entered into agreements to acquire or lease, over 46 billion MHz-POPs of spectrum in the United States. Of this over

46 billion MHz-POPs of spectrum in the United States, we estimate that we own approximately 42% of those MHz-

POPs with the remainder being leased from third parties, generally under lease terms that extend up to 30 years. As of

December 31, 2010, the weighted average remaining life of these spectrum leases based on the value of all payments

that we are amortizing over the life of the spectrum leases was approximately 25 years, including renewal terms.

Our pending spectrum acquisition and lease agreements are subject to various closing conditions, some of

which are outside of our control and, as a result, we may not acquire or lease all of the spectrum that is subject to

these agreements. Nearly all of such closing conditions relate either to licensee or FCC consents, which we expect

are likely to be granted. A limited number of our pending acquisition agreements are subject to closing conditions

involving the resolution of bankruptcy or similar proceedings. As of December 31, 2010, we had minimum

purchase commitments of approximately $9.9 million to acquire new spectrum. Under our current business plans,

we do not anticipate making any further material spectrum acquisitions without additional funding.

We engineer our networks to optimize both the service that we offer and the number of subscribers to whom we

can offer service. Upon the change to 4G mobile broadband technology, we generally do not expect to launch our

services in a market unless we control, through license or lease, a minimum of three contiguous blocks of 10 MHz of

spectrum bandwidth. However, we expect the spectral efficiency of technologies we deploy to continue to evolve,

and as a result, we may decide to deploy our services in some markets with less spectrum. Alternatively, we may

find that new technologies and subscriber usage patterns make it necessary or practical for us to have more spectrum

available in our markets prior to launching our services in that market.

International

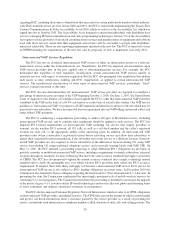

As of December 31, 2010, we held spectrum rights in Belgium, Germany and Spain. We also held minority

investments in companies that holds spectrum in Mexico and Ireland. In each of Germany and Spain, our licenses

cover the entire country. Our licenses in Belgium cover a significant portion of the country’s population. A summary

of the international spectrum rights held by our subsidiaries is below, including the frequency band in which the

spectrum is held, an estimate of the population covered by our spectrum in each country and the total MHz-POPs of

our spectrum.

Country

Frequency

(GHz)

Licensed

population(1) MHz-POPs(2)

(In millions) (In millions)

Belgium ...................................... 3.5 7.2 720.8

Germany ...................................... 3.5 82.8 3,477.6

Spain ........................................ 3.5 45.5 1,820.0

(1) Estimates based on country population data derived from the Economist Intelligence Unit database.

(2) Represents the amount of our spectrum in a given area, measured in MHz, multiplied by the estimated

population of that area.

As in the United States, we engineer our international networks to optimize the number of users that the

network can support while providing sufficient capacity and bandwidth. Thus far, we have chosen not to launch our

services in a market using our current technology unless we control a minimum of 30 MHz of spectrum. However,

we expect the spectral efficiency of technologies we deploy to continue to evolve, and as a result, we may decide to

deploy our services in some markets with less spectrum. Alternatively, as in the United States, we could find that

new technologies and subscriber usage patterns require us to have more spectrum than our current minimum

available in our markets.

15