Clearwire 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

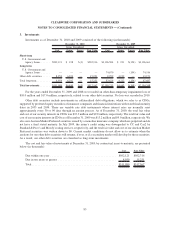

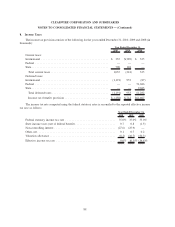

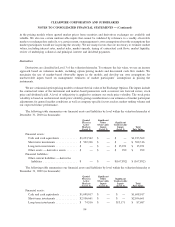

8. Income Taxes

The income tax provision consists of the following for the years ended December 31, 2010, 2009 and 2008 (in

thousands):

2010 2009 2008

Year Ended December 31,

Current taxes:

International ........................................... $ 335 $(389) $ 325

Federal . . . ............................................ — — —

State ................................................. 700 148 —

Total current taxes ..................................... 1,035 (241) 325

Deferred taxes:

International ........................................... (1,191) 953 (87)

Federal . . . ............................................ — — 51,686

State ................................................. — — 9,683

Total deferred taxes .................................... (1,191) 953 61,282

Income tax (benefit) provision ............................ $ (156) $ 712 $61,607

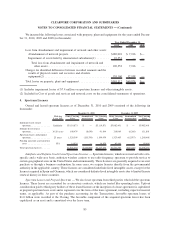

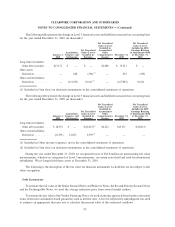

The income tax rate computed using the federal statutory rates is reconciled to the reported effective income

tax rate as follows:

2010 2009 2008

Year Ended December 31,

Federal statutory income tax rate ................................ 35.0% 35.0% 35.0%

State income taxes (net of federal benefit) .......................... 0.7 0.8 (1.5)

Non-controlling interest ....................................... (27.6) (25.9) —

Other, net.................................................. 0.1 0.7 0.2

Valuation allowance .......................................... (8.2) (10.7) (50.3)

Effective income tax rate ...................................... 0.0% (0.1)% (16.6)%

88

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)