Clearwire 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

answered the Statement of Claim and asserted counterclaims seeking related relief under the 4G MVNO

Agreement. On February 7, 2011, Clearwire filed its reply to Sprint’s counterclaims, denying all material

allegations in Sprint’s response and counterclaims and asserting various affirmative defenses. The action will

proceed before a single arbitrator, but no arbitrator has been appointed yet and no final hearing dates have been

scheduled. Finally, while not part of this arbitration action, the parties have served on each other various notices

preserving their rights to arbitrate certain invoices relating to multi-mode devices submitted by both parties under

the 3G MVNO and 4G MVNO Agreements. But no arbitration action has been commenced with regard to any of

those invoices at this time. The process is in the early stages, and its outcome is unknown.

On November 15, 2010 a purported class action was filed by Angelo Dennings against Clearwire in the

U.S. District Court for the Western District of Washington. The complaint generally alleges we slow network speeds

when network demand is highest and that such network management violates our agreements with subscribers and

is contrary to the company’s advertising and marketing claims. Plaintiffs also allege that subscribers do not review

the Terms of Service prior to subscribing, and when subscribers cancel service due to network management, we

charge an ETF or restocking fee that they claim is unconscionable under the circumstances. The claims asserted

include violations of the Computer Fraud and Abuse Act, breach of contract, breach of the covenant of good faith

and fair dealing and unjust enrichment. Plaintiffs seek class certification; unspecified damages and restitution; a

declaratory judgment that Clearwire’s ETF and restocking fee are unconscionable under the alleged circumstances;

an injunction prohibiting Clearwire from engaging in alleged deceptive marketing and from charging ETFs;

interest; and attorneys’ fees and costs. Plaintiff had indicated that it will file an Amended Complaint adding

additional class representatives by March 3, 2011. If the Amended Complaint is filed, Clearwire’s responsive

motions are due March 31, 2011. This case is in the early stages of litigation, its outcome is unknown and an

estimate of any potential loss cannot be made at this time.

In addition to the matters described above, we are often involved in certain other proceedings which seek

monetary damages and other relief. Based upon information currently available to us, none of these other claims are

expected to have a material adverse effect on our business, financial condition or results of operations.

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of

Equity Securities

Market Prices of Common Stock

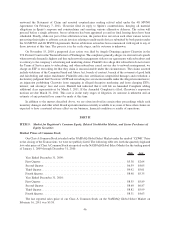

Our Class A Common Stock is traded on the NASDAQ Global Select Market under the symbol “CLWR.” Prior

to the closing of the Transactions, we were not publicly listed. The following table sets forth the quarterly high and

low sales prices of Class A Common Stock as reported on the NASDAQ Global Select Market for the trading period

of January 1, 2009 through December 31, 2010:

High Low

Year Ended December 31, 2009:

First Quarter ..................................................... $5.38 $2.64

Second Quarter ................................................... $6.59 $4.05

Third Quarter ..................................................... $9.42 $5.01

Fourth Quarter .................................................... $8.48 $5.35

Year Ended December 31, 2010:

First Quarter ..................................................... $8.55 $5.89

Second Quarter ................................................... $8.60 $6.87

Third Quarter ..................................................... $8.82 $5.99

Fourth Quarter .................................................... $8.31 $4.63

The last reported sales price of our Class A Common Stock on the NASDAQ Global Select Market on

February 16, 2011 was $5.38.

46