Clearwire 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Each holder of Clearwire Communications Class B Common Interests holds an equivalent number of shares of

Clearwire’s Class B Common Stock and will be entitled at any time to exchange one share of Class B Common

Stock plus one Clearwire Communications Class B Common Interest for one share of Class A Common Stock.

It is intended that at all times, the number of Clearwire Communications Class A Common Interests held by

Clearwire will equal the number of shares of Class A Common Stock issued by Clearwire. Similarly, it is intended

that, at all times, Sprint and each Investor, except Google, will hold an equal number of shares of Class B Common

Stock and Clearwire Communications Class B Common Interests.

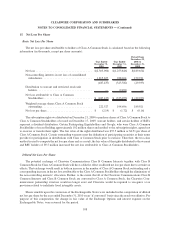

Dividend Policy

We have not declared or paid any cash dividends on Class A or Class B Common Stock since the Closing. We

currently expect to retain future earnings, if any, for use in the operations and expansion of our business. We do not

anticipate paying any cash dividends in the foreseeable future. In addition, covenants in the indenture governing our

Senior Secured Notes impose significant restrictions on our ability to pay cash dividends to our stockholders. The

distribution of subscription rights as part of the Rights Offering represents a stock dividend distribution.

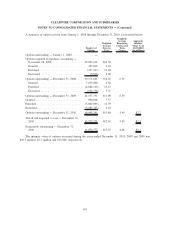

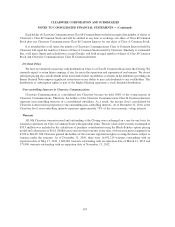

Non-controlling Interests in Clearwire Communications

Clearwire Communications is consolidated into Clearwire because we hold 100% of the voting interest in

Clearwire Communications. Therefore, the holders of the Clearwire Communications Class B Common Interests

represent non-controlling interests in a consolidated subsidiary. As a result, the income (loss) consolidated by

Clearwire is decreased in proportion to the outstanding non-controlling interests. As of December 31, 2010, at the

Clearwire level, non-controlling interests represent approximately 75% of the non-economic voting interests.

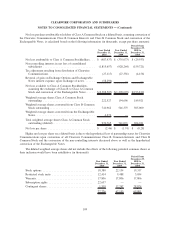

Warrants

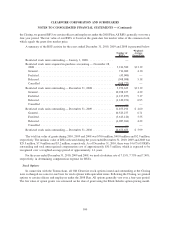

All Old Clearwire warrants issued and outstanding at the Closing were exchanged on a one-for-one basis for

warrants to purchase our Class A Common Stock with equivalent terms. The fair value of the warrants exchanged of

$18.5 million was included in the calculation of purchase consideration using the Black-Scholes option pricing

model and a share price of $6.62. Holders may exercise their warrants at any time, with exercise prices ranging from

$3.00 to $48.00. Old Clearwire granted the holders of the warrants registration rights covering the shares subject to

issuance under the warrants. As of December 31, 2010, there were 16,031,219 warrants outstanding with an

expiration date of May 17, 2011, 1,400,001 warrants outstanding with an expiration date of March 12, 2012 and

375,000 warrants outstanding with an expiration date of November 13, 2012.

107

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)