Cablevision 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(87)

similar tax loss, or a tax credit carryforward exists. ASU No. 2013-11 eliminates the current diversity in

practice in the presentation of unrecognized tax benefits either where an entity may present unrecognized

tax benefits as a liability (unless the unrecognized tax benefit is directly associated with a tax position

taken in a tax year that results in, or that resulted in, the recognition of a net operating loss or tax credit

carryforward for that year and the net operating loss or tax credit carryforward has not been utilized) or by

presenting unrecognized tax benefits as a reduction of a deferred tax asset for a net operating loss or tax

credit carryforward in certain circumstances. We will adopt ASU No. 2013-11 prospectively for all

unrecognized tax benefits that exist after January 1, 2014. ASU No. 2013-11 will not have any impact on

the Company's consolidated financial statements upon adoption.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

All dollar amounts, except per customer, per unit and per share data, included in the following discussion

under this Item 7A are presented in thousands.

Equity Price Risk

We are exposed to market risks from changes in certain equity security prices. Our exposure to changes

in equity security prices stems primarily from the shares of Comcast Corporation common stock we hold.

We have entered into equity derivative contracts consisting of a collateralized loan and an equity collar to

hedge our equity price risk and to monetize the value of these securities. These contracts, at maturity, are

expected to offset declines in the fair value of these securities below the hedge price per share while

allowing us to retain upside appreciation from the hedge price per share to the relevant cap price. The

contracts' actual hedge prices per share vary depending on average stock prices in effect at the time the

contracts were executed. The contracts' actual cap prices vary depending on the maturity and terms of

each contract, among other factors. If any one of these contracts is terminated prior to its scheduled

maturity date due to the occurrence of an event specified in the contract, we would be obligated to repay

the fair value of the collateralized indebtedness less the sum of the fair values of the underlying stock and

equity collar, calculated at the termination date. As of December 31, 2013, we did not have an early

termination shortfall relating to these contracts.

The underlying stock and the equity collars are carried at fair value on our consolidated balance sheets

and the collateralized indebtedness is carried at its accreted value. The carrying value of our

collateralized indebtedness amounted to $817,950 at December 31, 2013. At maturity, the contracts

provide for the option to deliver cash or shares of Comcast common stock, with a value determined by

reference to the applicable stock price at maturity.

As of December 31, 2013, the fair value and the carrying value of our holdings of Comcast common stock

aggregated $1,116,084. Assuming a 10% change in price, the potential change in the fair value of these

investments would be approximately $111,608. As of December 31, 2013, the net fair value and the

carrying value of the equity collar component of the equity derivative contracts entered into to partially

hedge the equity price risk of our holdings of Comcast common stock aggregated $143,562, a net liability

position. For the year ended December 31, 2013, we recorded a net loss on our outstanding equity

derivative contracts of $198,688 and recorded unrealized gains of $313,251 on our holdings of Comcast

common stock that we held during the period.

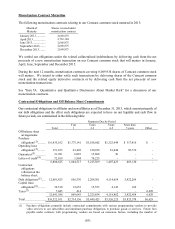

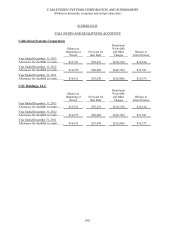

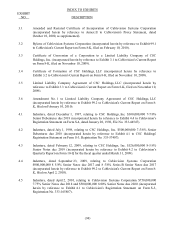

Fair Value of Equity Derivative Contracts

Fair value as of December 31, 2012, net liability position .................................................................

.

$(145,120)

Change in fair value, net ..................................................................................................................

.

(198,688)

Settlement of contracts ....................................................................................................................

.

200,246

Fair value as of December 31, 2013, net liability position .................................................................

.

$(143,562)