Cablevision 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-54

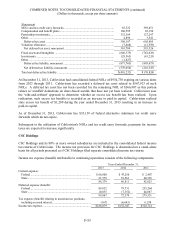

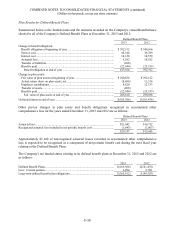

Income tax expense attributable to discontinued operations for the year ended December 31, 2013 of

$240,412 is comprised of current income tax expense and deferred income tax benefit of $299,353 and

$58,941, respectively. Income tax expense attributable to discontinued operations for the year ended

December 31, 2012 of $110,581 is comprised of current and deferred income tax expense of $28,242 and

$82,339, respectively. Income tax expense attributable to discontinued operations for the year ended

December 31, 2011 of $25,276 is comprised of current income tax benefit, deferred income tax expense

and income tax expense related to uncertain tax positions of $7,101, $28,360, and $4,017, respectively.

In connection with the tax allocation policy between CSC Holdings and Cablevision, CSC Holdings

decreased the affiliate receivable due from Cablevision by $340,344, representing the estimated current

income tax liability of CSC Holdings for the year ended December 31, 2013 as determined on a stand-

alone basis, partially offset by an excess tax benefit realized of $46,164 and current income tax liabilities

that are payable by CSC Holdings of $1,224.

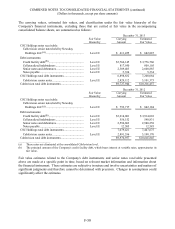

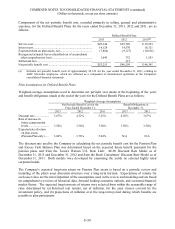

The income tax expense (benefit) attributable to CSC Holdings' continuing operations differs from the

amount derived by applying the statutory federal rate to pretax income principally due to the effect of the

following items:

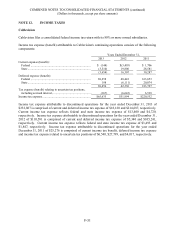

Years Ended December 31,

2013 2012 2011

Federal tax expense at statutory rate...............................................

.

$167,098 $132,864 $264,061

State income taxes, net of federal benefit .......................................

.

27,177 22,542 50,401

Changes in the valuation allowance ...............................................

.

(101) 1,038 1,822

Changes in the state apportionment rates used to measure

deferred taxes, net of federal benefit ..........................................

.

(6,484) 1,188 5,800

Tax expense (benefit) relating to uncertain tax positions,

including accrued interest, net of deferred tax benefits ..............

.

(124) (2,659) 1,699

Impact of non-deductible officers' compensation, net ....................

.

796 470 77

Other non-deductible expenses.......................................................

.

3,628 3,363 3,618

Increase in the deferred tax asset for certain state tax loss carry

forwards pursuant to LLC conversions of certain subsidiaries ...

.

- (3,935) -

Research credit ...............................................................................

.

(3,739) - (1,800)

Tax expense (benefit) from exclusion of pretax loss (income) of

an entity that is not consolidated for income tax purposes .........

.

- (2,605) 2,509

Other, net ........................................................................................

.

(172) 281 527

Income tax expense ........................................................................

.

$188,079 $152,547 $328,714