Cablevision 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(31)

As of February 21, 2014, there were 867 holders of record of CNYG Class A common stock.

There is no public trading market for the CNYG Class B common stock, par value $.01 per share. As of

February 21, 2014, there were 23 holders of record of CNYG Class B common stock.

All membership interests in CSC Holdings are held by Cablevision.

Stockholder Dividends and Distributions

Cablevision

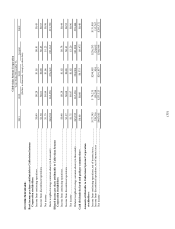

The Board of Directors of Cablevision declared the following cash dividends to stockholders of record on

both its CNYG Class A common stock and CNYG Class B common stock:

Declaration Date Dividend per Share Record Date Payment Date

November 6, 2013 $0.15 November 22, 2013 December 13, 2013

July 30, 2013 $0.15 August 15, 2013 September 5, 2013

May 7, 2013 $0.15 May 24, 2013 June 14, 2013

February 26, 2013 $0.15 March 15, 2013 April 3, 2013

October 24, 2012 $0.15 November 7, 2012 November 28, 2012

August 1, 2012 $0.15 August 14, 2012 September 4, 2012

May 1, 2012 $0.15 May 17, 2012 June 1, 2012

February 22, 2012 $0.15 March 9, 2012 March 30, 2012

Cablevision paid dividends aggregating $159.7 million and $163.9 million in 2013 and 2012,

respectively, primarily from the proceeds of equity distribution payments from CSC Holdings. In

addition, as of December 31, 2013, up to approximately $6.1 million will be paid when, and if,

restrictions lapse on restricted shares outstanding.

Cablevision may pay dividends on its capital stock only from net profits and surplus as determined under

Delaware law. If dividends are paid on the CNYG common stock, holders of the CNYG Class A

common stock and CNYG Class B common stock are entitled to receive dividends, and other

distributions in cash, stock or property, equally on a per share basis, except that stock dividends with

respect to CNYG Class A common stock may be paid only with shares of CNYG Class A common stock

and stock dividends with respect to CNYG Class B common stock may be paid only with shares of

CNYG Class B common stock.

Cablevision's indentures restrict the amount of dividends and distributions in respect of any equity interest

that can be made.

CSC Holdings

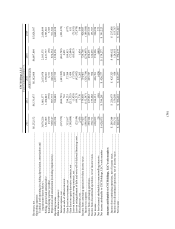

During the years ended December 31, 2013 and 2012, CSC Holdings made equity distribution cash

payments to Cablevision, its sole member, aggregating approximately $501.2 million and $671.8 million,

respectively. These distribution payments were funded from cash on hand. The proceeds were used to

fund:

x Cablevision's dividends paid;

x Cablevision's interest and principal payments on its senior notes;

x Cablevision's payments for the acquisition of treasury shares related to statutory minimum tax

withholding obligations upon the vesting of certain restricted shares;

x Cablevision's repurchases of certain outstanding senior notes in 2013; and

x the repurchase of CNYG Class A common stock under Cablevision's share repurchase program

in 2012.