Cablevision 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(65)

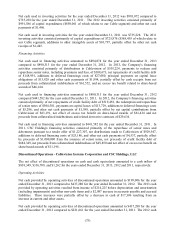

Business Segments Results

Cable

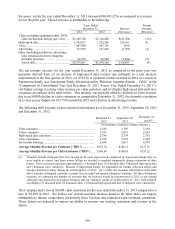

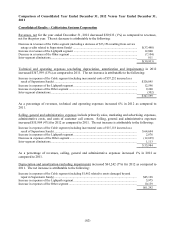

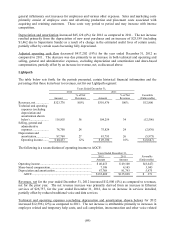

The table below sets forth, for the periods presented, certain historical financial information and the

percentage that those items bear to revenues, net for our Cable segment:

Years Ended December 31,

2012 2011

Amount

% of Net

Revenues

Amount

% of Net

Revenues

Favorable

(Unfavorable)

Revenues, net .................

.

$5,479,108 100% $5,516,548

100%

$ (37,440)

Technical and operating

expenses (excluding

depreciation and

amortization shown

below) ........................

.

2,645,835 48 2,319,790

42

(326,045)

Selling, general and

administrative

expenses .....................

.

1,073,589 20 1,008,895

18

(64,694)

Depreciation and

amortization ................

.

742,681 14 697,553

13

(45,128)

Operating income........

.

$1,017,003 19% $1,490,310

27%

$(473,307)

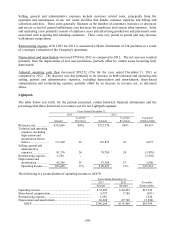

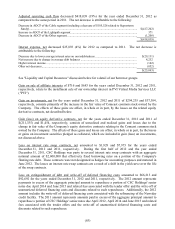

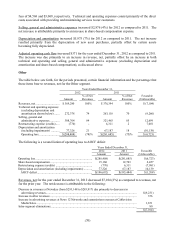

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2012

2011

Favorable

Amount

Amount

(Unfavorable)

Operating income .................................................................. $1,017,003

$1,490,310

$(473,307)

Share-based compensation ..................................................... 38,357

27,380

10,977

Depreciation and amortization ............................................... 742,681

697,553

45,128

AOCF ............................................................................. $1,798,041

$2,215,243

$(417,202)

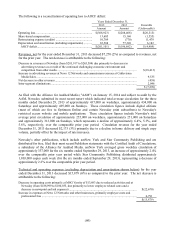

Superstorm Sandy

On October 29, 2012, Superstorm Sandy made landfall in our service area, resulting in widespread power

outages and service disruptions for almost 60% of our customers, as well as damage to certain portions of

our cable network.

The following table summarizes service outage credits which reduced revenues, net, incremental costs,

depreciation and capital expenditures related to Superstorm Sandy for the year ended December 31, 2012:

Revenues, net .................................................................................................................................. $ 33,156

Operating expenses:

Technical and operating expenses................................................................................................. 57,252

Selling, general and administrative expenses ................................................................................ 15,118

Impact to AOCF .............................................................................................................................. 105,526

Depreciation ................................................................................................................................ 1,462

Impact to operating income.............................................................................................................. $106,988

Capital expenditures ........................................................................................................................ $ 5,639