Cablevision 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-37

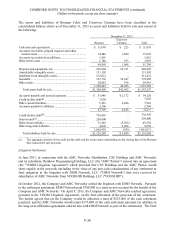

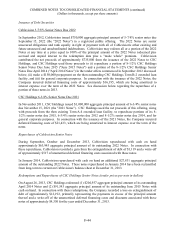

allocation was approved by independent committees of the Boards of Directors of the Company and

AMC Networks. On April 9, 2013, the Company received $175,000 from AMC Networks (in addition to

the $350,000 initially distributed to the Company from the joint escrow account in December 2012). The

proceeds of $175,000 and $350,000 were recorded as a gain in discontinued operations for the year ended

December 31, 2013 and 2012, respectively.

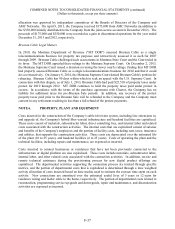

Bresnan Cable Legal Matters

In 2010, the Montana Department of Revenue ("MT DOR") assessed Bresnan Cable as a single

telecommunications business for property tax purposes and retroactively assessed it as such for 2007

through 2009. Bresnan Cable challenged such assessments in Montana State Court and the Court ruled in

its favor. The MT DOR appealed these rulings to the Montana Supreme Court. On December 2, 2013,

the Montana Supreme Court issued a decision reversing the lower court's rulings, finding that MT DOR

had properly assessed Bresnan Cable as a single telecommunications business for 2010 and that it could

do so retroactively. On January 8, 2014, the Montana Supreme Court denied Bresnan Cable's petition for

rehearing. Bresnan Cable has 90 days within which to seek an appeal with the U.S. Supreme Court. In

connection with this dispute, as of July 1, 2013, Bresnan Cable had paid $25,510 of property taxes under

protest for 2010 through 2012. MT DOR continues to hold the property taxes paid under protest in

escrow. In accordance with the terms of the purchase agreement with Charter, the Company has no

liability for additional taxes for pre-Bresnan Sale periods. In addition, any recovery of the protest

property taxes paid prior to the Bresnan Sale will be refunded to the Company and the Company must

consent to any settlement resulting in less than a full refund of the protest payments.

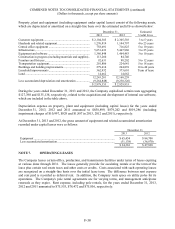

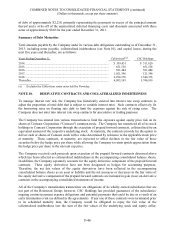

NOTE 6. PROPERTY, PLANT AND EQUIPMENT

Costs incurred in the construction of the Company's cable television system, including line extensions to,

and upgrade of, the Company's hybrid fiber-coaxial infrastructure and headend facilities are capitalized.

These costs consist of materials, subcontractor labor, direct consulting fees, and internal labor and related

costs associated with the construction activities. The internal costs that are capitalized consist of salaries

and benefits of the Company's employees and the portion of facility costs, including rent, taxes, insurance

and utilities, that supports the construction activities. These costs are depreciated over the estimated life

of the plant (10 to 25 years), and headend facilities (4 to 25 years). Costs of operating the plant and the

technical facilities, including repairs and maintenance, are expensed as incurred.

Costs incurred to connect businesses or residences that have not been previously connected to the

infrastructure or digital platform are also capitalized. These costs include materials, subcontractor labor,

internal labor, and other related costs associated with the connection activities. In addition, on-site and

remote technical assistance during the provisioning process for new digital product offerings are

capitalized. The departmental activities supporting the connection process are tracked through specific

metrics, and the portion of departmental costs that is capitalized is determined through a time weighted

activity allocation of costs incurred based on time studies used to estimate the average time spent on each

activity. New connections are amortized over the estimated useful lives of 5 years or 12 years for

residence wiring and feeder cable to the home, respectively. The portion of departmental costs related to

reconnection, programming service up-grade and down-grade, repair and maintenance, and disconnection

activities are expensed as incurred.