Cablevision 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(60)

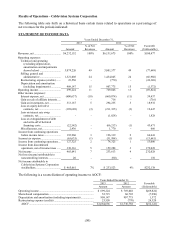

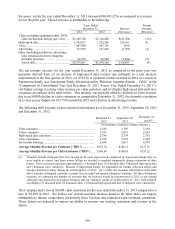

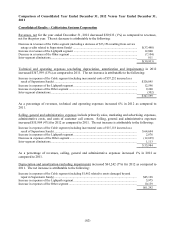

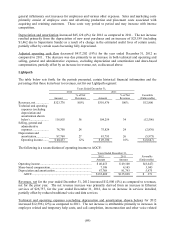

The following is a reconciliation of operating loss to AOCF deficit:

Years Ended December 31,

2013

2012

Favorable

Amount

Amount

(Unfavorable)

Operating loss ........................................................................

.

$(308,923)

$(288,408)

$(20,515)

Share-based compensation .....................................................

.

13,605

15,160

(1,555)

Restructuring expense (credits) ..............................................

.

10,709

(770)

11,479

Depreciation and amortization (including impairments) ..........

.

83,508

77,326

6,182

AOCF deficit ......................................................................

.

$(201,101)

$(196,692)

$ (4,409)

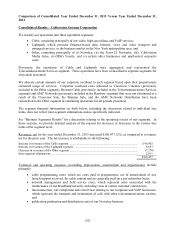

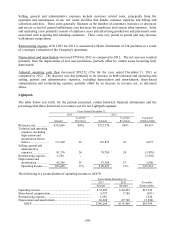

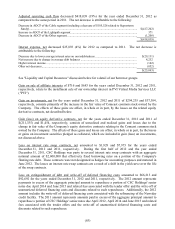

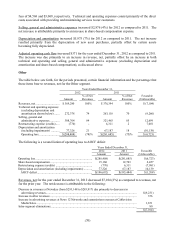

Revenues, net for the year ended December 31, 2013 decreased $7,270 (2%) as compared to revenues, net

for the prior year. The net decrease is attributable to the following:

Decrease in revenues at Newsday (from $283,917 to $265,504) due primarily to decreases in

advertising revenues as a result of the continued challenging economic environment and

competition from other media ...................................................................................................... $(18,413)

Increase in advertising revenues at News 12 Networks and commission revenues at Cablevision

Media Sales ................................................................................................................................. 9,535

Net decrease in other revenues ......................................................................................................... (438)

Intra-segment eliminations............................................................................................................... 2,046

$ (7,270)

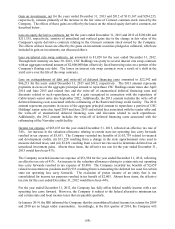

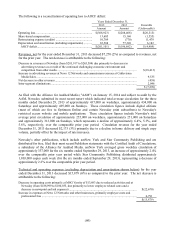

As filed with the Alliance for Audited Media ("AAM") on January 15, 2014 and subject to audit by the

AAM, Newsday submitted its most recent report which indicated total average circulation for the three

months ended December 29, 2013 of approximately 437,000 on weekdays, approximately 434,000 on

Saturdays and approximately 495,000 on Sundays. These circulation figures include digital editions

(most of which are free to Optimum Online and certain Newsday print subscribers) to Newsday's

restricted access website and mobile applications. These circulation figures include Newsday's total

average print circulation of approximately 255,000 on weekdays, approximately 251,000 on Saturdays

and approximately 313,000 on Sundays, which represents a decline of approximately 6.4%, 5.3%, and

5.6%, respectively, over the comparable prior year period. Circulation revenue for the year ended

December 31, 2013 decreased $2,175 (3%) primarily due to a decline in home delivery and single copy

volume, partially offset by the impact of rate increases.

Newsday's other publications, which include amNew York and Star Community Publishing and are

distributed for free, filed their most recent Publishers statements with the Certified Audit of Circulations,

a subsidiary of the Alliance for Audited Media. amNew York averaged gross weekday circulation of

approximately 337,000 for the six months ended September 29, 2013, an increase of approximately 2.4%

over the comparable prior year period while Star Community Publishing distributed approximately

1,803,000 copies each week (for the six months ended September 29, 2013), representing a decrease of

approximately 2.2% over the comparable prior year period.

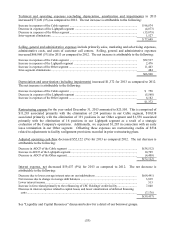

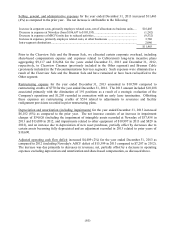

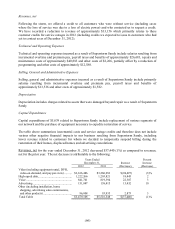

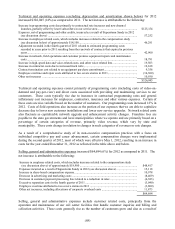

Technical and operating expenses (excluding depreciation and amortization shown below) for the year

ended December 31, 2013 decreased $15,879 (6%) as compared to the prior year. The net decrease is

attributable to the following:

Decrease in operating costs primarily at MSG Varsity of $13,693 due to reduced activities and at

Newsday (from $188,999 to $180,035, due primarily to lower employee related costs and a

decrease in newsprint and ink expenses) ....................................................................................... $(22,670)

Increase in expenses at News 12 Networks and other businesses, primarily employee costs and

professional fees .......................................................................................................................... 6,791

$(15,879)