Cablevision 2013 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

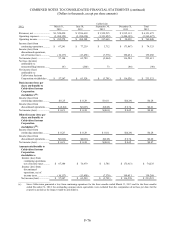

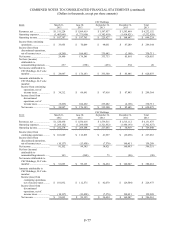

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-71

was filed in that court on February 22, 2011. Plaintiffs asserted claims for breach of contract, unjust

enrichment, and consumer fraud, seeking unspecified compensatory damages, punitive damages and

attorneys' fees. On March 28, 2012, the Court ruled on the Company's motion to dismiss, denying the

motion with regard to plaintiffs' breach of contract claim, but granting it with regard to the remaining

claims, which were dismissed. On April 16, 2012, plaintiffs filed a second consolidated amended

complaint, which asserts a claim only for breach of contract. The Company's answer was filed on May 2,

2012. On October 10, 2012, plaintiffs filed a motion for class certification and on December 13, 2012, a

motion for partial summary judgment. Both motions have been fully briefed, and a decision by the Court

is pending. Further discovery, if any, has been deferred until after the Court rules on the pending

motions. The Company believes that this claim is without merit and intends to defend these lawsuits

vigorously, but is unable to predict the outcome of these lawsuits or reasonably estimate a range of

possible loss.

Livingston v. Cablevision Systems Corporation, et al.: On January 26, 2012, a securities lawsuit was filed

in the U.S. District Court for the Eastern District of New York against Cablevision and certain current and

former officers, by a Cablevision shareholder, purportedly on behalf of a class of individuals who

purchased Cablevision common stock between February 16, 2011, and October 28, 2011. The complaint

alleged that Cablevision and the individual defendants violated Section 10(b) of the Securities Exchange

Act by allegedly issuing materially false and misleading statements regarding (i) the Company's customer

retention and advertising costs, and (ii) the Company's loss of video customers, especially in the New

York area. The complaint also alleged that the individual defendants violated Section 20(a) of the

Securities Exchange Act for the same alleged conduct. Plaintiff seeks unspecified monetary damages,

attorneys' fees, and equitable relief. Defendants filed a motion to dismiss on October 18, 2012. On

September 5, 2013, the Court issued a decision granting the motion to dismiss in its entirety and

dismissing the complaint with prejudice. Plaintiffs did not file a notice of appeal within the statutory time

frame. The Company believes this matter is now concluded.

Wandel v. Cablevision Systems Corporation, et al.: On February 24, 2012, a shareholder derivative

complaint was filed in New York Supreme Court, Nassau County, purportedly on behalf of the nominal

defendant Cablevision against all members of Cablevision's Board of Directors. The complaint alleges,

among other things, that the individual defendants violated the fiduciary duties they owe to Cablevision

by allegedly causing or allowing the Company to issue materially false and misleading statements

regarding (i) the Company's customer retention and advertising costs; and (ii) the Company's loss of

video customers, especially in the New York area. The complaint seeks unspecified monetary damages,

restitution, attorneys' fees, and equitable relief. In 2012, the parties entered into a stipulation staying

discovery until the U.S. District Court in the Livingston matter (above) ruled on any motion to dismiss,

and relieving defendants of the obligation to answer or otherwise respond to the complaint until plaintiff

filed an amended complaint. Pursuant to the stipulation of the parties, plaintiff had 30 days from the date

of the decision in Livingston (above) to file an amended complaint. No amended complaint has been

filed.

Patent Litigation

Cablevision is named as a defendant in certain lawsuits claiming infringement of various patents relating

to various aspects of the Company's businesses. In certain of these cases other industry participants are

also defendants. In certain of these cases the Company expects that any potential liability would be the

responsibility of the Company's equipment vendors pursuant to applicable contractual indemnification

provisions. The Company believes that the claims are without merit and intends to defend the actions

vigorously, but is unable to predict the outcome of these lawsuits or reasonably estimate a range of

possible loss.