Cablevision 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(82)

floating rate term loan which matures on October 12, 2016 (net of the $160,000 repayment in December

2013 discussed below). Interest under the Newsday Credit Agreement is calculated, at the election of

Newsday LLC, at either the base rate or the eurodollar rate, plus 2.50% or 3.50%, respectively, as

specified in the Newsday Credit Agreement. Borrowings by Newsday LLC under the Newsday Credit

Agreement are guaranteed by CSC Holdings on a senior unsecured basis and certain of its subsidiaries

that own interests in Newsday LLC on a senior secured basis. The Newsday Credit Agreement is secured

by a lien on the assets of Newsday LLC and Cablevision senior notes with an aggregate principal amount

of $611,455 (after the sale of Cablevision senior notes in December 2013 discussed below) owned by

Newsday Holdings. In connection with the Newsday Credit Agreement, the Company incurred deferred

financing costs of approximately $4,558, which are being amortized to interest expense over the term of

the Newsday Credit Agreement.

On December 10, 2013, Newsday LLC made a voluntary repayment of $160,000 on its term loan with the

proceeds it received from CSC Holdings in connection with CSC Holdings' purchase of Cablevision

senior notes with an aggregate principal amount of $142,262 held by Newsday Holdings. The senior

notes were subsequently distributed by CSC Holdings to Cablevision and were canceled.

The principal financial covenant for the Newsday Credit Agreement is a minimum liquidity test of

$25,000 which is tested bi-annually on June 30 and December 31. The Newsday Credit Agreement also

contains customary affirmative and negative covenants, subject to certain exceptions, including

limitations on indebtedness, investments and restricted payments. Certain of the covenants applicable to

CSC Holdings under the Newsday Credit Agreement are similar to the covenants applicable to CSC

Holdings under its outstanding senior notes.

Newsday LLC was in compliance with its financial covenant under the Newsday Credit Agreement as of

December 31, 2013.

Capital Expenditures

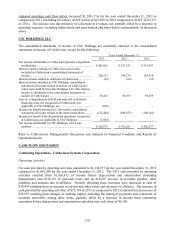

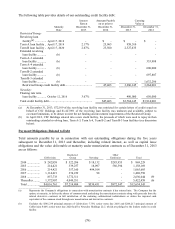

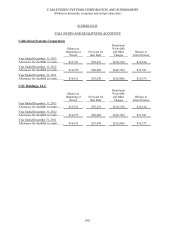

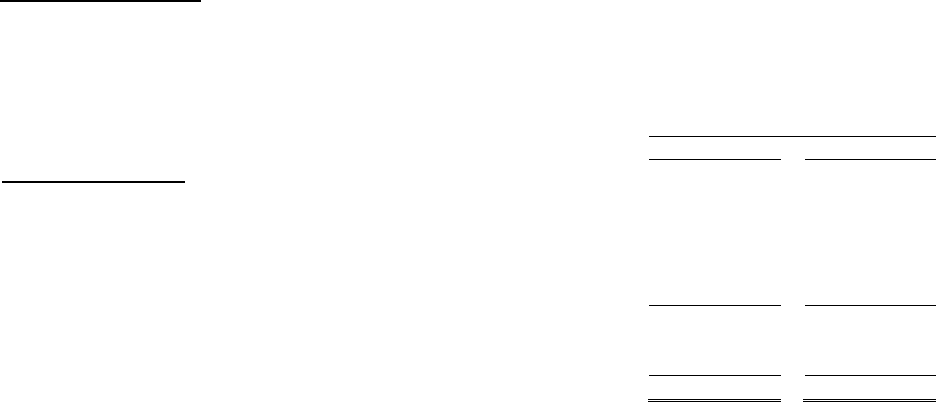

The following table provides details of the Company's capital expenditures for continuing operations for

the years ended December 31, 2013 and 2012:

Years Ended

December 31,

2013

2012

Capital Expenditures

Customer premise equipment .............................................................................

$251,886

$299,112

Scalable infrastructure ........................................................................................

311,162

305,720

Line extensions ..................................................................................................

29,040

28,666

Upgrade/rebuild .................................................................................................

34,402

19,525

Support ..............................................................................................................

180,188

197,038

Total Cable .....................................................................................................

806,678

850,061

Lightpath ...........................................................................................................

111,830

93,460

Other .................................................................................................................

33,171

48,065

Total Cablevision ............................................................................................

$951,679

$991,586

Capital expenditures for 2013 decreased $39,907 (4%) as compared to 2012. This decrease was primarily

related to a decrease in purchases of customer premise equipment, equipment for remote storage DVR

and vehicles, partially offset by additional spending for equipment to enhance broadband capacity and

speed and to expand our WiFi network.