Cablevision 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-34

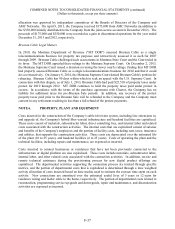

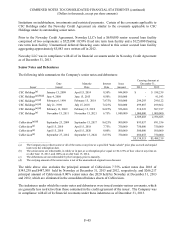

impairments) in the Other segment. No goodwill impairments were recorded for the years ended

December 31, 2013, 2012 and 2011.

In addition, the Company recorded impairment charges of $10,997, $829 and $1,887 in 2013, 2012 and

2011, respectively, included in depreciation and amortization related primarily to certain other long-lived

assets of businesses included in the Other segment.

NOTE 5. DISCONTINUED OPERATIONS AND ASSETS AND LIABILITIES HELD FOR

SALE

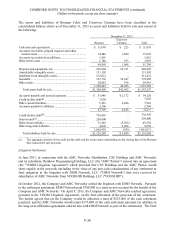

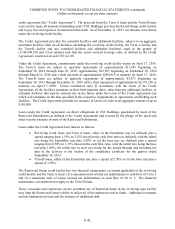

In connection with the Bresnan Sale and Clearview Sale discussed above, the operating results of Bresnan

Cable (previously included in the Company's Telecommunications Services segment) and Clearview

Cinemas (previously included in the Company's Other segment) have been reflected in the Company's

consolidated financial statements as discontinued operations for all periods presented. The assets and

liabilities attributable to Bresnan Cable and Clearview Cinemas have been classified as assets and

liabilities held for sale in the consolidated balance sheets as of December 31, 2012.

The proceeds related to the settlement of litigation with DISH Network, LLC (see discussion below) and

related costs have been classified in discontinued operations for the years ended December 31, 2013 and

2012.

In addition, on June 30, 2011, the Company completed the AMC Networks Distribution (see Note 1). As

a result, the operating results of the Company's Rainbow segment through the date of the AMC Networks

Distribution, as well as transaction costs, have been classified in the consolidated statements of income as

discontinued operations for all periods presented. No gain or loss was recognized in connection with the

AMC Networks Distribution.

Operating results of discontinued operations for the years ended December 31, 2013, 2012 and 2011 are

summarized below:

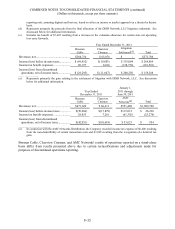

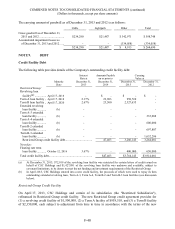

Year Ended December 31, 2013

Bresnan

Cable(a)

Clearview

Cinemas(b)(c)

Litigation

Settlement(d) Total

Revenues, net............................................. $ 262,323

$ 27,307 $ - $ 289,630

Income (loss) before income taxes .............. $ 439,870

$(42,437) $173,690 $ 571,123

Income tax benefit (expense)(e) .................. (180,178)

17,425 (70,054) (232,807)

Income (loss) from discontinued

operations, net of income taxes -

Cablevision ............................................. 259,692

(25,012) 103,636 338,316

Income tax benefit recognized at

Cablevision, not applicable to CSC

Holdings ................................................. (6,602)

- (1,003) (7,605)

Income (loss) from discontinued

operations, net of income taxes - CSC

Holdings ................................................. $ 253,090

$(25,012) $102,633 $ 330,711

___________________________

(a) Includes the pretax gain recognized in connection with the Bresnan Sale of approximately $408,000.

(b) Includes the pretax loss recognized in connection with the Clearview Sale of approximately $19,300.

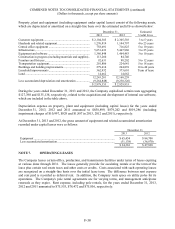

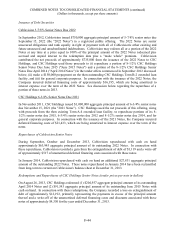

(c) As a result of the Company's annual impairment test in the first quarter of 2013, the Company recorded an

impairment charge of $10,347, relating to goodwill of the Company's Clearview business which reduced the

carrying value to zero. The Company determined the fair value of the Clearview business, which was a single