Cablevision 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

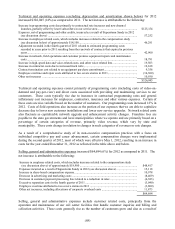

(64)

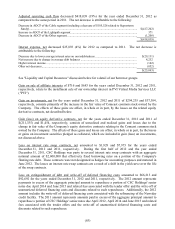

Income tax expense of $51,994 for the year ended December 31, 2012, reflected an effective tax rate of

41%. An increase in the valuation allowance relating to certain state net operating loss carry forwards

resulted in tax expense of $5,480. The Company recorded tax benefits of $2,659 related to uncertain tax

positions and $3,935 resulting from re-measuring the deferred tax asset for certain state net operating loss

carry forwards. The exclusion of pretax income of an entity that is not consolidated for income tax

purposes resulted in tax benefit of $2,605. Absent these items, the effective tax rate for the year ended

December 31, 2012 would have been 44%.

The Company recorded income tax expense of $220,552 for the year ended December 31, 2011,

reflecting an effective tax rate of 43%. The Company recorded tax expense of $2,233 due to the impact

of a change in the state rate used to measure deferred taxes. An increase in the valuation allowance

relating to certain state net operating loss carry forwards resulted in tax expense of $1,822. The Company

recorded tax expense of $1,699 related to uncertain tax positions. In addition, the exclusion of the pretax

loss of an entity that is not consolidated for income tax purposes resulted in additional tax expense of

$2,509. Absent these items, the effective tax rate for the year ended December 31, 2011 would have been

41%.

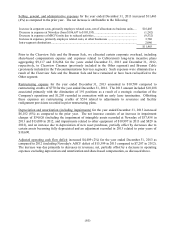

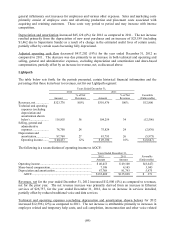

Income from discontinued operations

Income from discontinued operations, net of income taxes, for the years ended December 31, 2012 and

2011 reflects the following items:

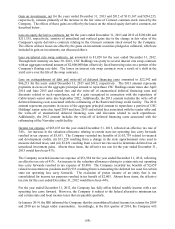

Years Ended December 31,

2012 2011

Litigation settlement, net of related costs, net of income taxes .............................. $200,250 $ -

Net operating results of Clearview Cinemas, net of income taxes ......................... (11,667) (10,618)

Net operating results of Bresnan Cable, net of income taxes ................................. (29,295) (42,051)

Net operating results of AMC Networks, including transaction costs, net of

income taxes(a) ................................................................................................. - 53,623

$159,288 $ 954

___________________________

(a) Includes the operating results of AMC Networks through the date of the AMC Networks Distribution.

See Note 5 to our consolidated financial statements for additional information regarding discontinued

operations.