Cablevision 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(76)

provided by operating activities resulted from income of $445,163, before depreciation and amortization

(including impairments) and other non-cash items and a $6,345 increase in accounts payable and accrued

liabilities. Partially offsetting these increases was a decrease in cash of $14,228 resulting from an

increase in current and other assets.

Net cash provided by operating activities of discontinued operations amounted to $221,661 for the year

ended December 31, 2011. The 2011 cash provided by operating activities resulted from income of

$219,580 before depreciation and amortization (including impairments), $188,294 of non-cash items, and

a $14,273 increase in accounts payable and accrued liabilities. Partially offsetting these increases was a

decrease in cash of $131,642 resulting from the acquisition of and payment of obligations relating to

program rights and a $68,844 increase in current and other assets.

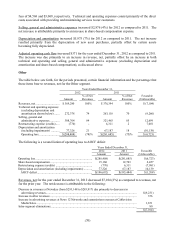

Investing Activities

Net cash provided by investing activities of discontinued operations for the year ended December 31,

2013 was $646,185 compared to net cash used in investing activities of discontinued operations of

$83,671 for the year ended December 31, 2012. The 2013 investing activities consisted primarily of

proceeds from the Bresnan Sale and the Clearview Sale aggregating $676,253, net of transaction costs,

and other net cash receipts of $12, partially offset by capital expenditures of $30,080.

Net cash used in investing activities of discontinued operations for the year ended December 31, 2012

was $83,671 compared to $100,771 for the year ended December 31, 2011. The 2012 investing activities

consisted primarily of capital expenditures.

Net cash used in investing activities of discontinued operations for the year ended December 31, 2011

was $100,771. The 2011 investing activities consisted of capital expenditures of $93,271, payments

related to the acquisition of Bresnan Cable of $7,776, partially offset by other net cash receipts of $276.

Financing Activities

Net cash used in financing activities of discontinued operations for the years ended December 31, 2013

and 2012 of $38,735 and $7,650, respectively, represented repayments of Bresnan Cable's credit facility

debt.

Net cash used in financing activities of discontinued operations for the year ended December 31, 2011

was $5,233. The 2011 financing activities consisted primarily of the repayment and repurchase of

$638,365 of senior notes, additions to deferred financing costs of $24,340 and payments on capital lease

obligations of $2,242, partially offset by net proceeds from AMC Networks and Bresnan Cable's credit

facility debt of $659,714.

LIQUIDITY AND CAPITAL RESOURCES

Cablevision

Cablevision has no operations independent of its subsidiaries. Cablevision's outstanding securities consist

of Cablevision NY Group ("CNYG") Class A common stock, CNYG Class B common stock and

approximately $3,447,000 of debt securities, including approximately $2,836,000 face value of debt

securities held by third party investors and approximately $611,000 held by Newsday Holdings LLC.

The $611,000 of notes are eliminated in Cablevision's consolidated financial statements and are shown as

senior notes due from Cablevision in the consolidated equity of CSC Holdings.