Cablevision 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-52

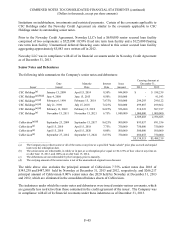

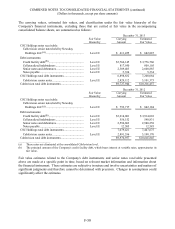

The income tax expense attributable to Cablevision's continuing operations differs from the amount

derived by applying the statutory federal rate to pretax income principally due to the effect of the

following items:

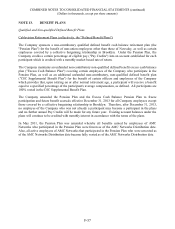

Years Ended December 31,

2013 2012 2011

Federal tax expense at statutory rate ........................................ $ 67,536 $44,212 $179,158

State income taxes, net of federal benefit ................................ 3,607 4,763 31,152

Changes in the valuation allowance ........................................ 5,631 5,480 1,822

Changes in the state apportionment rates used to measure

deferred taxes, net of federal benefit .................................... (11,228) 2,273 2,233

Tax expense (benefit) relating to uncertain tax positions,

including accrued interest, net of deferred tax benefits ......... (124) (2,659) 1,699

Impact of non-deductible officers' compensation ..................... 796 470 77

Other non-deductible expenses ............................................... 3,628 3,363 3,618

Increase in the deferred tax asset for certain state tax loss

carry forwards pursuant to LLC conversions of certain

subsidiaries ......................................................................... - (3,935) -

Research credit ....................................................................... (3,739) - (1,800)

Tax expense (benefit) from exclusion of pretax loss

(income) of an entity that is not consolidated for income

tax purposes ........................................................................ - (2,605) 2,509

Other, net ............................................................................... (472) 632 84

Income tax expense ................................................................ $ 65,635 $51,994 $220,552

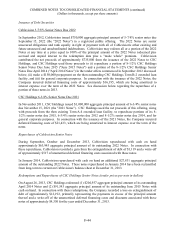

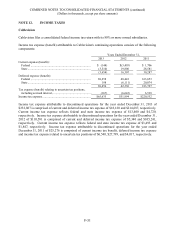

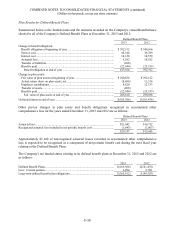

For Cablevision, the tax effects of temporary differences which give rise to significant portions of

deferred tax assets or liabilities and the corresponding valuation allowance at December 31, 2013 and

2012 are as follows:

December 31,

2013

2012

Deferred Tax Asset (Liability)

Current

NOLs and tax credit carry forwards .................................................................

$ 224,968

$ 170,407

Compensation and benefit plans ......................................................................

44,629

37,556

Allowance for doubtful accounts .....................................................................

5,502

4,807

Other liabilities ...............................................................................................

13,389

11,958

Deferred tax asset ........................................................................................

288,488

224,728

Valuation allowance........................................................................................

(6,988)

(4,194)

Net deferred tax asset, current ......................................................................

281,500

220,534

Investments.....................................................................................................

(97,565)

(63,950)

Prepaid expenses .............................................................................................

(24,111)

(17,061)

Deferred tax liability, current .......................................................................

(121,676)

(81,011)

Net deferred tax asset, current .........................................................................

159,824

139,523