Cablevision 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(72)

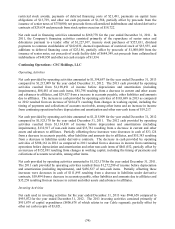

Adjusted operating cash flow deficit increased $1,208 (1%) for the year ended December 31, 2012 as

compared to 2011 (including Newsday's AOCF deficit of $(7,207) in 2012 compared to AOCF of $7,237

in 2011). The increase was due primarily to a decrease in revenues, net, partially offset by a decrease in

operating expenses excluding depreciation and amortization and share-based compensation, as discussed

above.

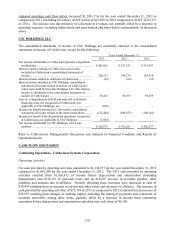

CSC HOLDINGS, LLC

The consolidated statements of income of CSC Holdings are essentially identical to the consolidated

statements of income of Cablevision, except for the following:

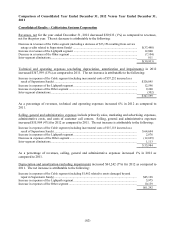

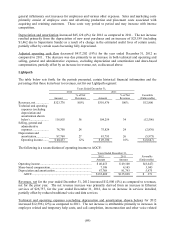

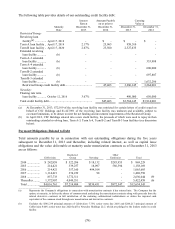

Years Ended December 31,

2013

2012

2011

Net income attributable to Cablevision Systems Corporation

stockholders .......................................................................

.

$ 465,661

$ 233,523

$ 291,857

Interest expense relating to Cablevision senior notes

included in Cablevision's consolidated statements of

income ...............................................................................

.

226,672

194,276

183,518

Interest income related to cash held at Cablevision ................

.

(42)

(64)

(15)

Interest income included in CSC Holdings' consolidated

statements of income related to interest on Cablevision's

senior notes held by Newsday Holdings LLC (this interest

income is eliminated in the consolidated statements of

income of Cablevision) ......................................................

.

58,435

59,079

59,079

Loss on extinguishment of debt and write-off of deferred

financing costs, net recognized at Cablevision, not

applicable to CSC Holdings, net .........................................

.

(602)

-

-

Income tax benefit included in Cablevision's consolidated

statements of income related to the items listed above .........

.

(122,444)

(100,553)

(108,162)

Income tax benefit from discontinued operations recognized

at Cablevision, not applicable to CSC Holdings ..................

.

(7,605)

-

-

Net income attributable to CSC Holdings, LLC's sole

member .............................................................................

.

$ 620,075

$ 386,261

$ 426,277

Refer to Cablevision's Management's Discussion and Analysis of Financial Condition and Results of

Operations herein.

CASH FLOW DISCUSSION

Continuing Operations - Cablevision Systems Corporation

Operating Activities

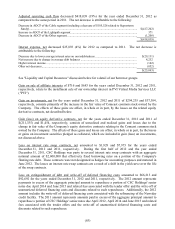

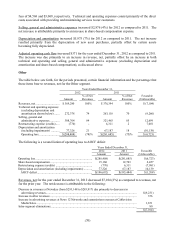

Net cash provided by operating activities amounted to $1,134,977 for the year ended December 31, 2013

compared to $1,061,208 for the year ended December 31, 2012. The 2013 cash provided by operating

activities resulted from $1,036,472 of income before depreciation and amortization (including

impairments) and $110,121 of non-cash items and an $18,879 increase in accounts payable, other

liabilities and amounts due to affiliates. Partially offsetting these increases were decreases in cash of

$30,495 resulting from an increase in current and other assets and advances to affiliates. The increase in

cash provided by operating activities of $73,769 in 2013 as compared to 2012 resulted from an increase of

$79,957 resulting from changes in working capital, including the timing of payments and collections of

accounts receivable, among other items, partially offset by a decrease in income from continuing

operations before depreciation and amortization and other non-cash items of $6,188.