Cablevision 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

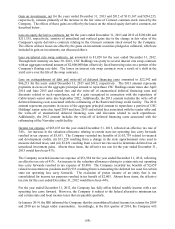

(55)

record income tax benefit of approximately $53,000 associated with the reversal of a noncurrent liability

relating to an uncertain tax position.

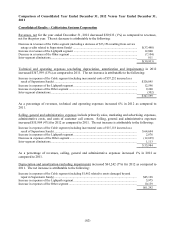

Income from discontinued operations

Income from discontinued operations, net of income taxes, for the years ended December 31, 2013 and

2012 reflects the following items:

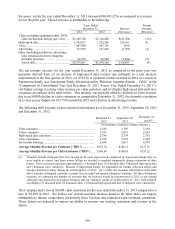

Years Ended December 31,

2013 2012

Litigation settlement, net of legal fees, net of income taxes .................................. $103,636 $200,250

Income (loss) of Bresnan Cable, including gain on sale in 2013, net of income

taxes ................................................................................................................. 259,692 (29,295)

Loss of Clearview Cinemas, including loss on sale in 2013, net of income taxes ... (25,012) (11,667)

Income from discontinued operations, net of income taxes - Cablevision .............. 338,316 159,288

Income tax benefit recognized at Cablevision, not applicable to CSC Holdings..... (7,605) -

Income from discontinued operations, net of income taxes - CSC Holdings .......... $330,711 $159,288

See Note 5 to our consolidated financial statements for additional information regarding discontinued

operations.

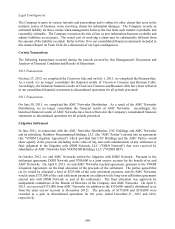

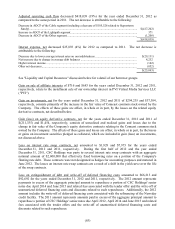

Business Segments Results

Cable

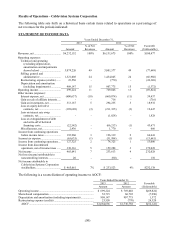

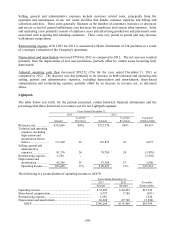

The table below sets forth, for the periods presented, certain historical financial information and the

percentage that those items bear to revenues, net for our Cable segment:

Years Ended December 31,

2013 2012

Amount

% of Net

Revenues

Amount

% of Net

Revenues

Favorable

(Unfavorable)

Revenues, net .................

.

$5,576,011 100% $5,479,108

100%

$ 96,903

Technical and operating

expenses (excluding

depreciation and

amortization shown

below) ........................

.

2,742,709 49 2,645,835

48

(96,874)

Selling, general and

administrative

expenses .....................

.

1,126,126 20 1,073,589

20

(52,537)

Restructuring expense ....... 11,283 - -

-

(11,283)

Depreciation and

amortization ................

.

743,431 13 742,681

14

(750)

Operating income........

.

$ 952,462 17% $1,017,003

19%

$(64,541)

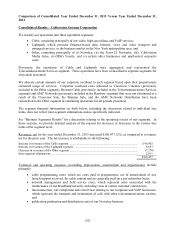

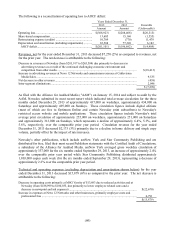

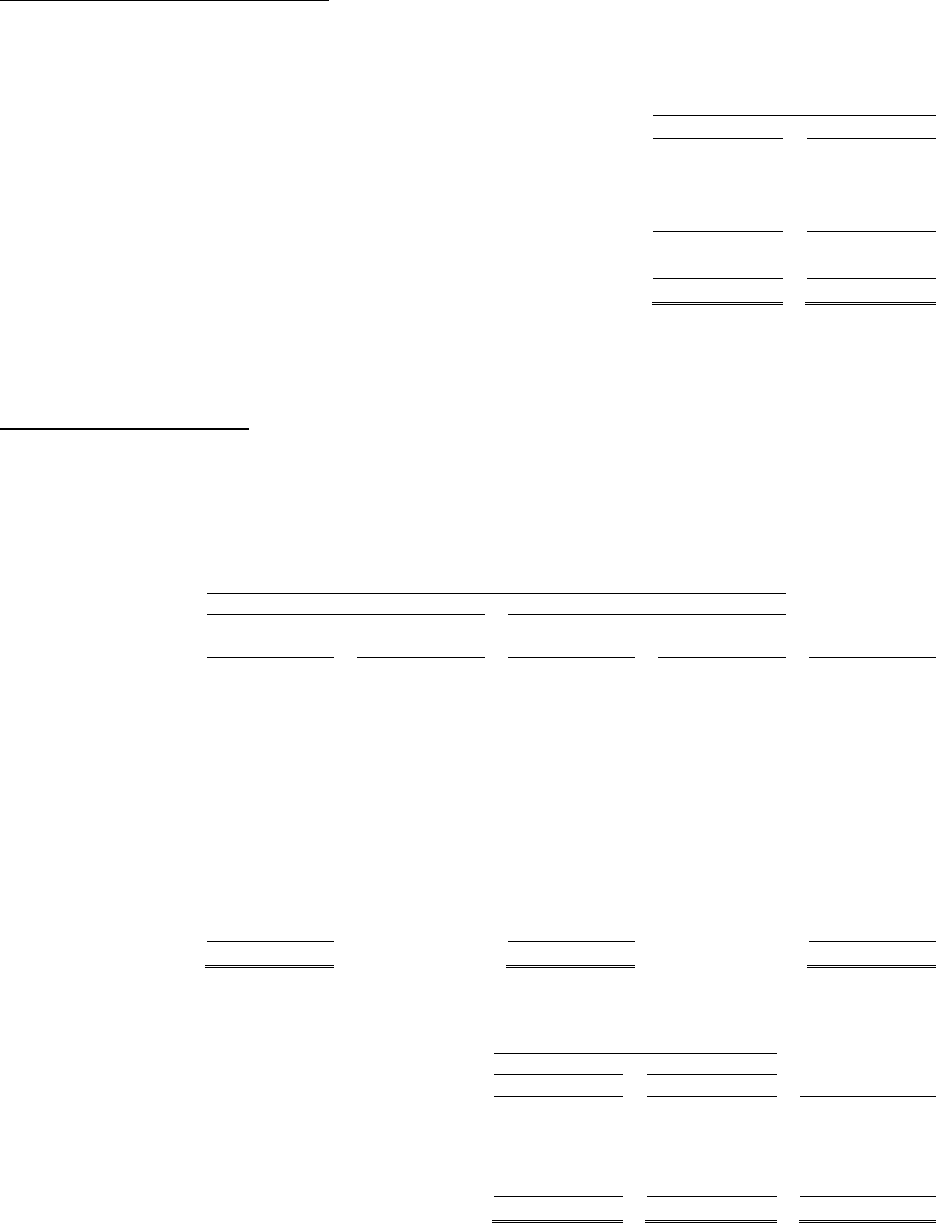

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2013

2012

Favorable

Amount

Amount

(Unfavorable)

Operating income .................................................................. $ 952,462

$1,017,003

$(64,541)

Share-based compensation ..................................................... 32,353

38,357

(6,004)

Restructuring expense............................................................ 11,283

-

11,283

Depreciation and amortization ............................................... 743,431

742,681

750

AOCF ............................................................................. $1,739,529

$1,798,041

$(58,512)