Cablevision 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(69)

general inflationary cost increases for employees and various other expenses. Sales and marketing costs

primarily consist of employee costs and advertising production and placement costs associated with

acquiring and retaining customers. These costs vary period to period and may increase with intense

competition.

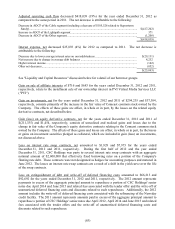

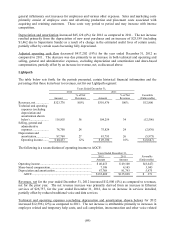

Depreciation and amortization increased $45,128 (6%) for 2012 as compared to 2011. The net increase

resulted primarily from the depreciation of new asset purchases and an increase of $23,189 (including

$1,462 due to Superstorm Sandy) as a result of a change in the estimated useful lives of certain assets,

partially offset by certain assets becoming fully depreciated.

Adjusted operating cash flow decreased $417,202 (19%) for the year ended December 31, 2012 as

compared to 2011. The decrease was due primarily to an increase in both technical and operating and

selling, general and administrative expenses, excluding depreciation and amortization and share-based

compensation, partially offset by an increase in revenue, net, as discussed above.

Lightpath

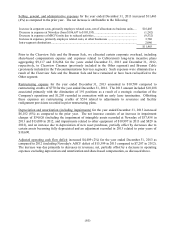

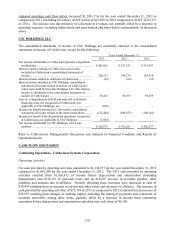

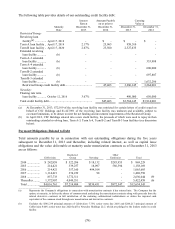

The table below sets forth, for the periods presented, certain historical financial information and the

percentage that those items bear to revenues, net for our Lightpath segment:

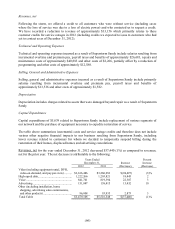

Years Ended December 31,

2012 2011

Amount

% of Net

Revenues

Amount

% of Net

Revenues

Favorable

(Unfavorable)

Revenues, net .................

.

$323,776 100% $310,976

100%

$12,800

Technical and operating

expenses (excluding

depreciation and

amortization shown

below) ........................

.

116,855 36 104,259

34

(12,596)

Selling, general and

administrative

expenses .....................

.

78,700 24 75,824

24

(2,876)

Depreciation and

amortization ................

.

87,768 27 81,793

26

(5,975)

Operating income........

.

$ 40,453 12% $ 49,100

16%

$ (8,647)

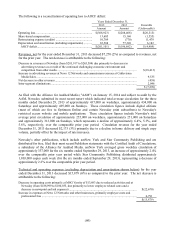

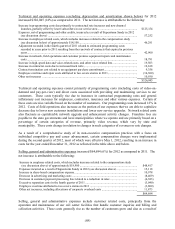

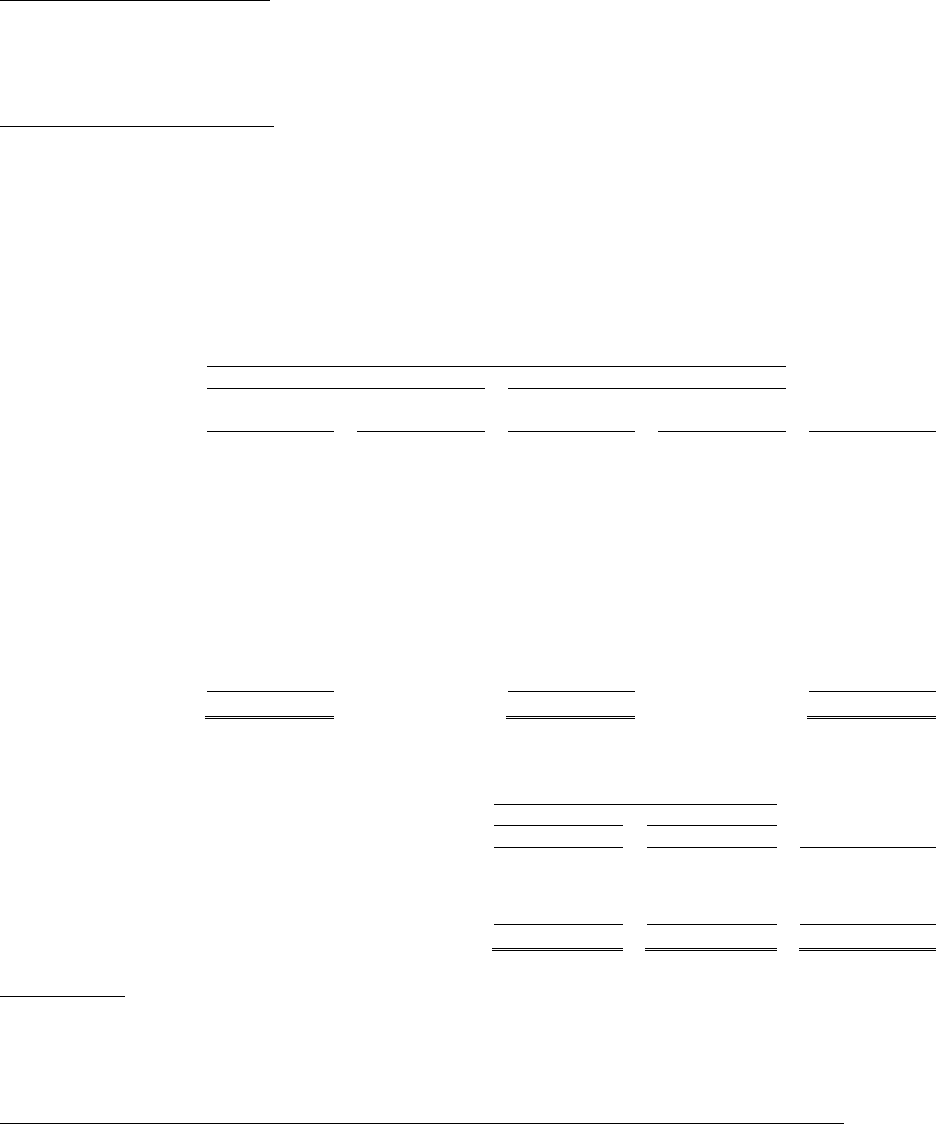

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2012

2011

Favorable

Amount

Amount

(Unfavorable)

Operating income .................................................................. $ 40,453

$ 49,100

$(8,647)

Share-based compensation ..................................................... 7,188

4,145

3,043

Depreciation and amortization ............................................... 87,768

81,793

5,975

AOCF ............................................................................. $135,409

$135,038

$ 371

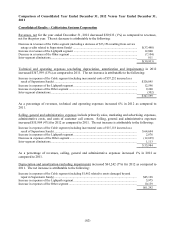

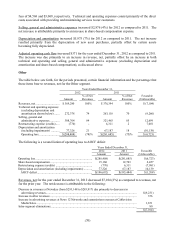

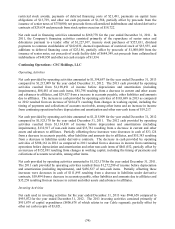

Revenues, net for the year ended December 31, 2012 increased $12,800 (4%) as compared to revenues,

net for the prior year. The net revenue increase was primarily derived from an increase in Ethernet

services of $26,757, for the year ended December 31, 2012, due to an increase in services installed,

partially offset by reduced traditional voice and data services.

Technical and operating expenses (excluding depreciation and amortization shown below) for 2012

increased $12,596 (12%) as compared to 2011. The net increase is attributable primarily to increases in

employee related and temporary help costs, and call completion, interconnection and other voice related