Cablevision 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(45)

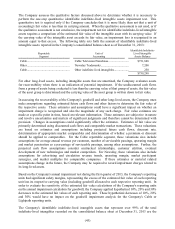

The Company assesses the qualitative factors discussed above to determine whether it is necessary to

perform the one-step quantitative identifiable indefinite-lived intangible assets impairment test. This

quantitative test is required only if the Company concludes that it is more likely than not that a unit of

accounting's fair value is less than its carrying amount. When the qualitative assessment is not used, or if

the qualitative assessment is not conclusive, the impairment test for identifiable indefinite-lived intangible

assets requires a comparison of the estimated fair value of the intangible asset with its carrying value. If

the carrying value of the intangible asset exceeds its fair value, an impairment loss is recognized in an

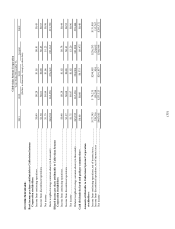

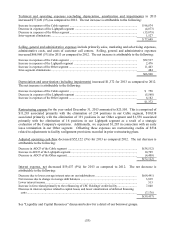

amount equal to that excess. The following table sets forth the amount of identifiable indefinite-lived

intangible assets reported in the Company's consolidated balance sheet as of December 31, 2013:

Reportable

Segment

Unit of

Accounting

Identifiable Indefinite-

Lived Intangible

Assets Balance

Cable ....................................................... Cable Television Franchises .........................

.

$731,848

Other ....................................................... Newsday Trademarks ...................................

.

7,200

Cable ....................................................... Other indefinite-lived intangibles ..................

.

250

$739,298

For other long-lived assets, including intangible assets that are amortized, the Company evaluates assets

for recoverability when there is an indication of potential impairment. If the undiscounted cash flows

from a group of assets being evaluated is less than the carrying value of that group of assets, the fair value

of the asset group is determined and the carrying value of the asset group is written down to fair value.

In assessing the recoverability of the Company's goodwill and other long-lived assets, the Company must

make assumptions regarding estimated future cash flows and other factors to determine the fair value of

the respective assets. These estimates and assumptions could have a significant impact on whether an

impairment charge is recognized and also the magnitude of any such charge. Fair value estimates are

made at a specific point in time, based on relevant information. These estimates are subjective in nature

and involve uncertainties and matters of significant judgments and therefore cannot be determined with

precision. Changes in assumptions could significantly affect the estimates. Estimates of fair value are

primarily determined using discounted cash flows and comparable market transactions. These valuations

are based on estimates and assumptions including projected future cash flows, discount rate,

determination of appropriate market comparables and determination of whether a premium or discount

should be applied to comparables. For the Cable reportable segment, these valuations also include

assumptions for average annual revenue per customer, number of serviceable passings, operating margin

and market penetration as a percentage of serviceable passings, among other assumptions. Further, the

projected cash flow assumptions consider contractual relationships, customer attrition, eventual

development of new technologies and market competition. For Newsday, these valuations also include

assumptions for advertising and circulation revenue trends, operating margin, market participant

synergies, and market multiples for comparable companies. If these estimates or material related

assumptions change in the future, the Company may be required to record impairment charges related to

its long-lived assets.

Based on the Company's annual impairment test during the first quarter of 2013, the Company's reporting

units had significant safety margins, representing the excess of the estimated fair value of each reporting

unit less its respective carrying value (including goodwill allocated to each respective reporting unit). In

order to evaluate the sensitivity of the estimated fair value calculations of the Company's reporting units

on the annual impairment calculation for goodwill, the Company applied hypothetical 10%, 20% and 30%

decreases to the estimated fair values of each reporting unit. These hypothetical decreases of 10%, 20%

and 30% would have no impact on the goodwill impairment analysis for the Company's Cable or

Lightpath reporting units.

The Company's identifiable indefinite-lived intangible assets that represent over 99% of the total

indefinite-lived intangibles recorded on the consolidated balance sheet at December 31, 2013 are the