Cablevision 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-41

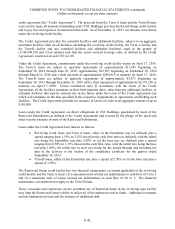

credit agreement (the "Credit Agreement"). The proceeds from the Term A loans and the Term B loans

were used to repay all amounts outstanding under CSC Holdings' previous Restricted Group credit facility

and to pay fees and expenses in connection therewith. As of December 31, 2013, no amounts were drawn

under the revolving credit facility.

The Credit Agreement provides for extended facilities and additional facilities, subject to an aggregate

maximum facilities limit on all facilities (including the revolving credit facility, the Term A facility and

the Term B facility and any extended facilities and additional facilities) equal to the greater of

(1) $4,808,510 and (2) an amount such that the senior secured leverage ratio, as defined in the Credit

Agreement, would not exceed 3.50 to 1.00.

Under the Credit Agreement, commitments under the revolving credit facility expire on April 17, 2018.

The Term A loans are subject to quarterly repayments of approximately $11,981 beginning on

September 30, 2014 through June 30, 2016, approximately $23,963 beginning on September 30, 2016

through March 31, 2018 and a final payment of approximately $694,919 at maturity on April 17, 2018.

The Term B loans are subject to quarterly repayments of approximately $5,875 beginning on

September 30, 2013 through December 31, 2019 with a final repayment of approximately $2,197,250 at

maturity on April 17, 2020. Unless terminated early in accordance with the terms of the Credit

Agreement, all the facilities terminate on their final maturity dates, other than any additional facilities or

extended facilities that may be entered into in the future under the terms of the Credit Agreement and

which will terminate on the date specified in the respective supplements or agreements establishing such

facilities. The Credit Agreement provides for issuance of letters of credit in an aggregate amount of up to

$150,000.

Loans under the Credit Agreement are direct obligations of CSC Holdings, guaranteed by most of the

Restricted Subsidiaries (as defined in the Credit Agreement) and secured by the pledge of the stock and

other security interests of most of the Restricted Subsidiaries.

Loans under the Credit Agreement bear interest as follows:

x Revolving credit loans and Term A loans, either (i) the Eurodollar rate (as defined) plus a

spread ranging from 1.50% to 2.25% based on the cash flow ratio (as defined), with the initial

rate being the Eurodollar rate plus 2.00% or (ii) the base rate (as defined) plus a spread

ranging from 0.50% to 1.25% based on the cash flow ratio, with the initial rate being the base

rate plus 1.00%, the initial rate in each case being for the period through and including the

date of the delivery to the lenders of the compliance certificate for the quarter ended

September 30, 2013;

x Term B loans, either (i) the Eurodollar rate plus a spread of 2.50% or (ii) the base rate plus a

spread of 1.50%.

The Restricted Group credit facility has two financial maintenance covenants applicable to the revolving

credit facility and the Term A loans: (1) a maximum ratio of total net indebtedness to cash flow of 5.0 to 1

and (2) a maximum ratio of senior secured net indebtedness to cash flow of 4.0 to 1. The financial

maintenance covenants do not apply to the Term B loans.

These covenants and restrictions on the permitted use of borrowed funds in the revolving loan facility

may limit the Restricted Group's ability to utilize all of the undrawn revolver funds. Additional covenants

include limitations on liens and the issuance of additional debt.