Cablevision 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

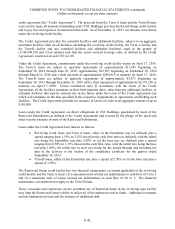

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-39

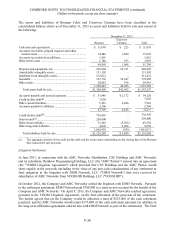

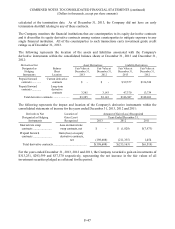

The minimum future annual payments for all operating leases for continuing operations (with initial or

remaining terms in excess of one year) during the next five years and thereafter, including pole rentals

from January 1, 2014 through December 31, 2018, at rates now in force are as follows:

2014 ................................................................................................................................................ $63,405

2015 ................................................................................................................................................ 63,049

2016 ................................................................................................................................................ 57,825

2017 ................................................................................................................................................ 46,353

2018 ................................................................................................................................................ 35,091

Thereafter........................................................................................................................................ 85,710

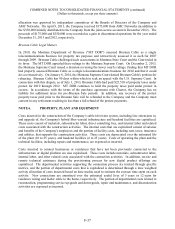

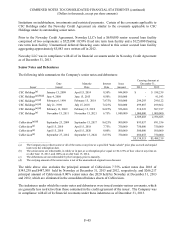

NOTE 8. INTANGIBLE ASSETS

The following table summarizes information relating to the Company's acquired intangible assets at

December 31, 2013 and 2012:

December 31, Estimated

2013

2012

Useful Lives

Gross carrying amount of amortizable intangible assets

Customer relationships ...................................................... $ 46,258

$ 46,258

7 to 18 years

Advertiser relationships..................................................... -

33,294

4 to 10 years

Other amortizable intangibles ............................................ 81,741

77,901

3 to 28 years

127,999

157,453

Accumulated amortization

Customer relationships ...................................................... (28,099)

(24,170)

Advertiser relationships..................................................... -

(18,497)

Other amortizable intangibles ............................................ (49,948)

(43,526)

(78,047)

(86,193)

Amortizable intangible assets, net of accumulated

amortization ...................................................................... $ 49,952

$ 71,260

Amortizable intangible assets, net of accumulated

amortization ...................................................................... $ 49,952

$ 71,260

Indefinite-lived cable television franchises ............................ 731,848

731,848

Trademarks and other indefinite-lived intangible assets ......... 7,450

32,550

Goodwill .............................................................................. 264,690

264,690

Total intangible assets, net .................................................... $1,053,940

$1,100,348

Aggregate amortization expense

Years ended December 31, 2013 and 2012 (excluding

impairment charges of $37,458 and $13,000,

respectively) .................................................................. $ 12,790

$ 15,533

Estimated amortization expense

Year ending December 31, 2014 ........................................... $ 8,162

Year ending December 31, 2015 ........................................... 7,237

Year ending December 31, 2016 ........................................... 6,439

Year ending December 31, 2017 ........................................... 5,995

Year ending December 31, 2018 ........................................... 4,966