Cablevision 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(51)

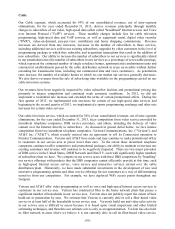

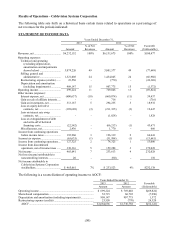

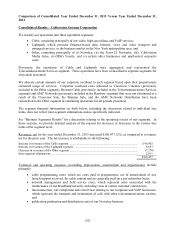

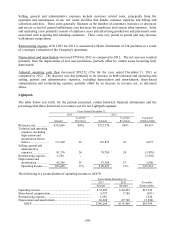

STATEMENT OF INCOME DATA (continued)

Years Ended December 31,

2012 2011

% of Net

% of Net Favorable

Amount Revenues

Amount

Revenues (Unfavorable)

Revenues, net ...................................... $6,131,675 100%

$6,162,608

100% $ (30,933)

Operating expenses:

Technical and operating

(excluding depreciation,

amortization and impairments

shown below) .............................. 3,001,577 49

2,653,978

43 (347,599)

Selling, general and

administrative .............................. 1,454,045 24

1,398,061

23 (55,984)

Restructuring expense (credits) ....... (770) -

6,311

- 7,081

Depreciation and amortization

(including impairments) .............. 907,775 15

846,533

14 (61,242)

Operating income ................................ 769,048 13

1,257,725

20 (488,677)

Other income (expense):

Interest expense, net ........................ (660,074) (11)

(685,967)

(11) 25,893

Gain on sale of affiliate interests ..... 716 -

683

- 33

Gain on investments, net ................. 294,235 5

37,384

1 256,851

Gain (loss) on equity derivative

contracts, net................................ (211,335) (3)

1,454

- (212,789)

Loss on interest rate swap

contracts, net................................ (1,828) -

(7,973)

- 6,145

Loss on extinguishment of debt

and write-off of deferred

financing costs ............................. (66,213) (1)

(92,692)

(2) 26,479

Miscellaneous, net ........................... 1,770 -

1,265

- 505

Income from continuing operations

before income taxes ........................ 126,319 2

511,879

8 (385,560)

Income tax expense ............................ (51,994) (1)

(220,552)

(4) 168,558

Income from continuing operations .... 74,325 1

291,327

5 (217,002)

Income from discontinued

operations, net of income taxes ...... 159,288 3

954

- 158,334

Net income ......................................... 233,613 4

292,281

5 (58,668)

Net income attributable to

noncontrolling interests .................. (90) -

(424)

- 334

Net income attributable to

Cablevision Systems Corporation

stockholders .................................... $ 233,523 4%

$ 291,857

5% $ (58,334)

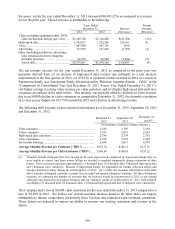

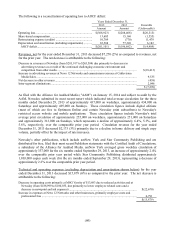

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2012 2011 Favorable

Amount Amount (Unfavorable)

Operating income ............................................................................

.

$ 769,048 $1,257,725 $(488,677)

Share-based compensation ..............................................................

.

60,705 44,228 16,477

Depreciation and amortization (including impairments) .................

.

907,775 846,533 61,242

Restructuring expense (credits) .......................................................

.

(770) 6,311 (7,081)

AOCF ..........................................................................................

.

$1,736,758 $2,154,797 $(418,039)