Cablevision 2013 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

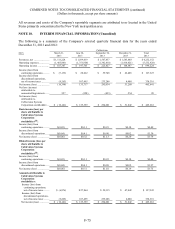

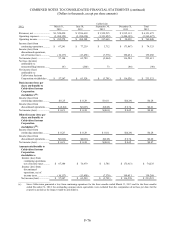

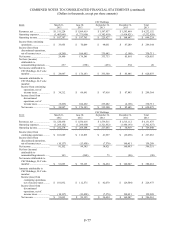

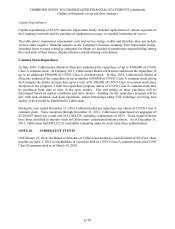

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-70

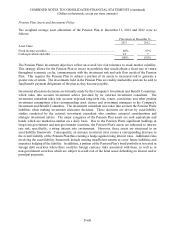

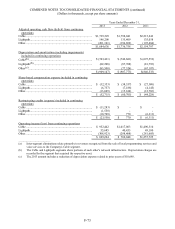

subscriber rates or the stated annual fee, as applicable, contained in the executed agreements in effect as of

December 31, 2013.

(b) Includes franchise and performance surety bonds primarily for the Company's Cable segment. Also includes

outstanding guarantees primarily by CSC Holdings in favor of certain financial institutions in respect of ongoing

interest expense obligations and potential early termination events in connection with the monetization of the

Company's holdings of shares of Comcast common stock. Does not include CSC Holdings' guarantee of Newsday

LLC's obligations under its $480,000 senior secured loan facility. Payments due by period for these arrangements

represent the year in which the commitment expires.

(c) Consists primarily of letters of credit obtained by CSC Holdings in favor of insurance providers and certain

governmental authorities for the Cable segment. Payments due by period for these arrangements represent the year

in which the commitment expires.

At any time after the thirteenth anniversary of the closing (which occurred on July 29, 2008) of the

Newsday acquisition and on or prior to the date that is six months after such anniversary, Tribune

Company will have the right to require CSC Holdings to purchase Tribune Company's entire interest in

Newsday Holdings LLC at the fair value of the interest at that time. The table above does not include any

future payments that would be required upon the exercise of this put right.

Many of the Company's franchise agreements and utility pole leases require the Company to remove its

cable wires and other equipment upon termination of the respective agreements. The Company has

concluded that the fair value of these asset retirement obligations cannot be reasonably estimated since

the range of potential settlement dates is not determinable.

Legal Matters

Cable Operations Litigation

Marchese, et al. v. Cablevision Systems Corporation and CSC Holdings, LLC: The Company is a

defendant in a lawsuit filed in the U.S. District Court for the District of New Jersey by several present and

former Cablevision subscribers, purportedly on behalf of a class of iO video subscribers in New Jersey,

Connecticut and New York. After three versions of the complaint were dismissed without prejudice by

the District Court, plaintiffs filed their third amended complaint on August 22, 2011, alleging that the

Company violated Section 1 of the Sherman Antitrust Act by allegedly tying the sale of interactive

services offered as part of iO television packages to the rental and use of set-top boxes distributed by

Cablevision, and violated Section 2 of the Sherman Antitrust Act by allegedly seeking to monopolize the

distribution of Cablevision compatible set-top boxes. Plaintiffs seek unspecified treble monetary

damages, attorney's fees, as well as injunctive and declaratory relief. On September 23, 2011, the

Company filed a motion to dismiss the third amended complaint. On January 10, 2012, the District Court

issued a decision dismissing with prejudice the Section 2 monopolization claim, but allowing the

Section 1 tying claim and related state common law claims to proceed. Cablevision's answer to the third

amended complaint was filed on February 13, 2012. Discovery is proceeding. The Company believes

that these claims are without merit and intends to defend this lawsuit vigorously, but is unable to predict

the outcome of the lawsuit or reasonably estimate a range of possible loss.

In re Cablevision Consumer Litigation: Following expiration of the affiliation agreements for carriage of

certain Fox broadcast stations and cable networks on October 16, 2010, News Corporation terminated

delivery of the programming feeds to the Company, and as a result, those stations and networks were

unavailable on the Company's cable television systems. On October 30, 2010, the Company and Fox

reached an agreement on new affiliation agreements for these stations and networks, and carriage was

restored. Several purported class action lawsuits were subsequently filed on behalf of the Company's

customers seeking recovery for the lack of Fox programming. Those lawsuits were consolidated in an

action before the U. S. District Court for the Eastern District of New York, and a consolidated complaint