Cablevision 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

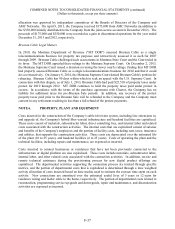

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

F-40

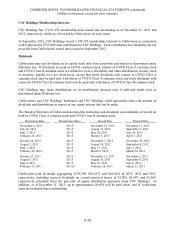

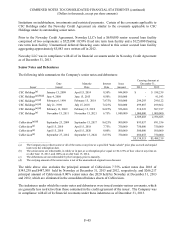

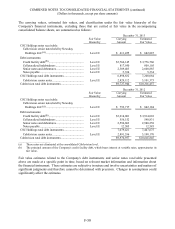

The carrying amount of goodwill as of December 31, 2013 and 2012 is as follows:

Cable Lightpath

Other

Total

Gross goodwill as of December 31,

2013 and 2012 ...............................

.

$234,290

$21,487

$ 342,971

$ 598,748

Accumulated impairment losses as

of December 31, 2013 and 2012 .....

.

-

-

(334,058)

(334,058)

$234,290 $21,487

$ 8,913

$ 264,690

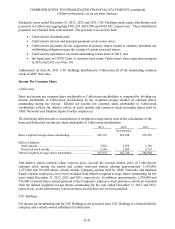

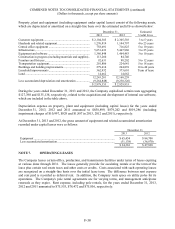

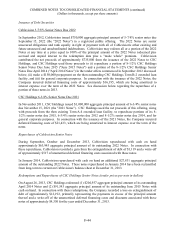

NOTE 9. DEBT

Credit Facility Debt

The following table provides details of the Company's outstanding credit facility debt:

Interest

Rate at

Amounts Payable

on or prior to

Carrying

Value at

Maturity

Date

December 31,

2013

December 31,

2014

December 31,

2013

December 31,

2012

Restricted Group:

Revolving loan

facility(a) ............... April 17, 2018 -

$ - $ - $ -

Term A loan facility .. April 17, 2018 2.17% 23,963 958,510 -

Term B loan facility .. April 17, 2020 2.67% 23,500 2,327,635 -

Extended revolving

loan facility ............ (b) -

- - -

Term A-3 extended

loan facility ............ (b) -

- - 333,908

Term A-4 extended

loan facility ............ (b) -

- - 600,000

Term B-2 extended

loan facility ............ (b) -

- - 697,807

Term B-3 extended

loan facility ............ (b) -

- - 1,632,286

Restricted Group credit facility debt................................... 47,463 3,286,145 3,264,001

Newsday:

Floating rate term

loan facility ............ October 12, 2016 3.67% - 480,000 650,000

Total credit facility debt........................................................ $47,463 $3,766,145 $3,914,001

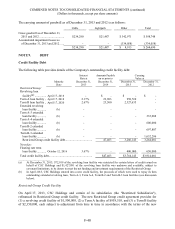

___________________________

(a) At December 31, 2013, $72,109 of the revolving loan facility was restricted for certain letters of credit issued on

behalf of CSC Holdings and $1,427,891 of the revolving loan facility was undrawn and available, subject to

covenant limitations, to be drawn to meet the net funding and investment requirements of the Restricted Group.

(b) In April 2013, CSC Holdings entered into a new credit facility, the proceeds of which were used to repay its then

outstanding extended revolving loan, Term A-3, Term A-4, Term B-2 and Term B-3 loan facilities (see discussion

below).

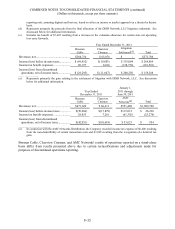

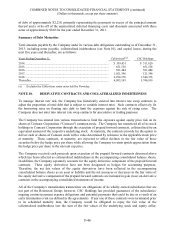

Restricted Group Credit Facility

On April 17, 2013, CSC Holdings and certain of its subsidiaries (the "Restricted Subsidiaries"),

refinanced its Restricted Group credit facility. The new Restricted Group credit agreement provides for

(1) a revolving credit facility of $1,500,000, (2) a Term A facility of $958,510, and (3) a Term B facility

of $2,350,000, each subject to adjustment from time to time in accordance with the terms of the new