Cablevision 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(86)

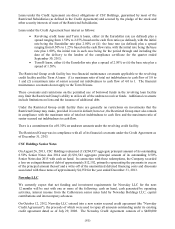

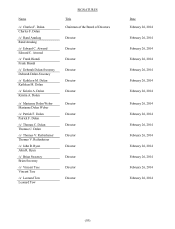

On February 25, 2014, the Board of Directors of Cablevision declared a cash dividend of $0.15 per share

payable on April 3, 2014 to stockholders of record on both its CNYG Class A common stock and CNYG

Class B common stock as of March 14, 2014.

Managing our Interest Rate and Equity Price Risk

Interest Rate Risk

Interest rate risk is primarily a result of exposures to changes in the level, slope and curvature of the yield

curve, the volatility of interest rates and credit spreads. Our exposure to interest rate risk results from

changes in short-term interest rates. Interest rate risk exists primarily with respect to our credit facility

debt, which bears interest at variable rates. The carrying value of our outstanding credit facility debt at

December 31, 2013 amounted to $3,766,145. To manage interest rate risk, we have from time to time

entered into various interest rate swap contracts to adjust the proportion of total debt that is subject to

variable interest rates. Such contracts effectively fix the borrowing rates on our floating rate debt to limit

the exposure against the risk of rising rates. We did not have any interest swap contracts in place at

December 31, 2013. We do not enter into interest rate swap contracts for speculative or trading purposes.

We monitor the financial institutions that are counterparties to our interest rate swap contracts and we

only enter into interest rate swap contracts with financial institutions that are rated investment grade. We

diversify our swap contracts among various counterparties to mitigate exposure to any single financial

institution. See discussion above for further details of our credit facility debt and See "Item 7A.

Quantitative and Qualitative Disclosures About Market Risk" below for a discussion regarding the fair

value of our debt.

Equity Price Risk

We have entered into derivative contracts to hedge our equity price risk and monetize the value of our

shares of common stock of Comcast Corporation. These contracts, at maturity, are expected to offset

declines in the fair value of these securities below the hedge price per share while allowing us to retain

upside appreciation from the hedge price per share to the relevant cap price. If any one of these contracts

is terminated prior to its scheduled maturity date due to the occurrence of an event specified in the

contract, we would be obligated to repay the fair value of the collateralized indebtedness less the sum of

the fair values of the underlying stock and equity collar, calculated at the termination date. As of

December 31, 2013, we did not have an early termination shortfall relating to any of these contracts. The

underlying stock and the equity collars are carried at fair value on our consolidated balance sheets and the

collateralized indebtedness is carried at its accreted value. See "Item 7A. Quantitative and Qualitative

Disclosures About Market Risk" for information on how we participate in changes in the market price of

the stocks underlying these derivative contracts.

All of our monetization transactions are obligations of our wholly-owned subsidiaries that are not part of

the Restricted Group; however, CSC Holdings provides guarantees of the subsidiaries' ongoing contract

payment expense obligations and potential payments that could be due as a result of an early termination

event (as defined in the agreements). The guarantee exposure approximates the net sum of the fair value

of the collateralized indebtedness less the sum of the fair values of the underlying stock and the equity

collar. All of our equity derivative contracts are carried at their current fair value on our consolidated

balance sheets with changes in value reflected in our consolidated statements of operations, and all of the

counterparties to such transactions currently carry investment grade credit ratings.

Recently Issued But Not Yet Adopted Accounting Pronouncements

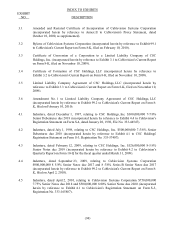

In July 2013, the Financial Accounting Standards Board issued Accounting Standards Update ("ASU")

No. 2013-11, Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a

Similar Tax Loss, or a Tax Credit Carryforward Exists. ASU No. 2013-11 provides guidance on the

financial statement presentation of an unrecognized tax benefit when a net operating loss carryforward, a